Speech to conference on Taming the Giant Corporation, organized by Ralph Nader and The Center for Study of Responsive Law, Washington DC, June 8, 2007

By Lucy Komisar

Remember Sam Wyly? Wyly  helped finance the Swift Boat campaign against John Kerry. In the last ten years, he has given more than $1 million to Republican candidates.

helped finance the Swift Boat campaign against John Kerry. In the last ten years, he has given more than $1 million to Republican candidates.

The beneficiaries include William H. Frist, Wilbert J. Tauzin, Thomas Delay, John D. Ashcroft, Richard J. Santorum, John S. McCain, Mitch McConnell, Dick Armey, Elizabeth H. Dole, Christine Todd Whitman, Orrin G. Hatch, Phil Gramm, Alfonse M. D‘Amato, Rudolph W. Giuliani and Arnold Schwarzenegger. He and his brother Sam were George W. Bush‘s 9th greatest career contributors.

That was your money. Wyly used the Isle of Man to hide taxes on nearly $1 billion in profits. At least, that was found by the investigative team of Sen. Carl Levin and was a focus of a hearing by Levin in August. Wyly has an admitted $1 billion net worth. You can bet his hidden wealth is a lot more.

The tax haven racket is the biggest scam in the world. It‘s run by the international banks with the cooperation of the world‘s financial powers for the benefit of corporations and the mega-rich. This talk is about strategy, but first you have to know the target, and most Americans, including progressive activist Americans, don‘t know what I‘m going to tell you. And that‘s part of the problem.

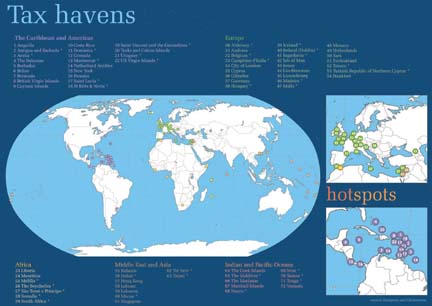

Tax havens, also known as offshore financial centers, are places that operate secret bank accounts and shell companies that hide the names of real owners from tax authorities and law enforcement of other countries. They use nominees, front men. Sometimes incorporation companies set up the shells. Sometimes the banks do it. Often someone will use a shell company in one jurisdiction that owns a shell in another jurisdiction that owns a bank account in a third. That‘s called layering. No one can follow the paper trial. Some trusts set up to hide money have a flee clause. If law enforcement comes snooping, the trust is automatically moved somewhere else.

The offshore system has two purposes. One is to launder the multi-billions of dollars of dirty money – illegal drug and arms sales, fraud, corruption and other criminal money so that it can enter the economies of the West.

I‘m going to crunch a lot of numbers to give you an idea of the scope.

Offshore is where most of the world’s drug money is laundered, estimated at up to $500 billion a year, more than the total income of the world‘s poorest 20 percent. Perhaps another $500 billion comes from fraud and corruption.

The IMF says that as much as $1.5 trillion of illicit money is laundered annually, equal to two to five percent of global economic output.

Wall Street wants this money. The markets would

shrivel without that cash. That‘s why Robert Rubin as Treasury Secretary had a policy, as Joseph Stiglitz told me, not to do anything that would stop the free flow of money into the U.S. He was not interested in stopping money laundering because the laundered funds ended up in Wall St, maybe in Goldman Sachs where he had worked, or Citibank, where he would work.

Attempts to find laundered funds are usually dismal failures. According to Interpol, $3 billion in dirty money has been seized in 20 years of struggle against money laundering — about the amount laundered in three days.

The other major purpose of offshore is for tax evasion, estimated to reach another $500 billion a year.

Corporations and the rich have opted out of the tax system. They have sophisticated mechanisms. There‘s transfer pricing. A company sets up a trading company offshore, sells its widgets there for under market price, the trading company sells it for market price, the profits are offshore, not where they really were generated.

Two American professors, using customs declarations, examined the impact of over-invoiced imports and under-invoiced exports on U.S. federal income tax revenues for 2001. Would you buy multiple vitamins from China at $850 a pound, plastic buckets from the Czech Republic for $973 each, tissues from China at $1874 a pound, a cotton dishtowel from Pakistan for $154, and tweezers from Japan at $4,896 each!

U.S. companies, at least on paper, were getting very little for their exported products. If you were in business, would you sell multiple vitamins to Finland at 61 cents a pound, bus and truck tires to Britain for $11.74 each, color video monitors to Pakistan for $21.90, and prefabricated buildings to Trinidad for $1.20 a unit.

Comparing all claimed export and import prices to real world prices, the professors figured the 2001 U.S. tax loss at $53.1 billion.

Transfer pricing is how Yukos oil chief Khodorkovsky cheated Russia of taxes.

Or a company sets up subsidiaries in tax havens – to own logos or intellectual property. Like

Microsoft does in Ireland, transferring software that was made in America, that benefited from work done by Americans, to Ireland so Microsoft can pay taxes there (at 11%) instead of here (at 35%). Why is Ireland getting the benefit of American-created software? It‘s legal. We need to change the law.

When logos are offshore, the company pays royalties to use the logo and deducts the amount as expenses. But the payments are not taxed or are taxed minimally where they are moved. Or a company has a tax haven public relations office which somehow is assigned a very large share of the profits. It‘s all part of profit laundering. When Dick Cheney ran Halliburton, it increased its offshore subsidiaries from 9 to at least 44.

Half of world trade is between various parts of the same corporations. Experts believe that as much as half the world’s capital flows through offshore centers. The totals held offshore include 31 percent of the net profits of U.S. multinationals.

The whole collection of tax scams is why between 1996 and 2000, of U.S. and multi-national corporations operating in the United States, with assets of at least $250 million or sales of at least $50 million, nearly two-thirds paid no U.S. income tax. Over 90 percent reported owing taxes of under 5 percent. In one year, six in ten paid less than a million.*

In 1996-2000, Goodyear‘s profits were $442 million, but it paid no taxes and got a $23-million rebate. Colgate-Palmolive made $1.6 billion and got back $21 million. Other companies that got rebates in 1998 included Texaco, Chevron, PepsiCo, Pfizer, J.P. Morgan, MCI Worldcom, General Motors, Phillips Petroleum and Northrop Grumman. Microsoft reported $12.3 billion U.S income in 1999 and paid zero federal taxes. In two recent years, Microsoft paid only 1.8 percent on $21.9 billion pretax U.S. profits.

During the 1950s, U.S. corporations accounted for 28 percent of federal revenues. Now, corporations represent just 11 percent. If big corporations paid taxes of 35 percent on their U.S. profits, as the law requires, corporate income taxes in 2002 would have been $308 billion instead of an estimated $136 billion.

Those unpaid taxes can buy a lot of politicians and power. When Richard Nixon needed money to pay the Watergate burglars, he got it from some corporate offshore bank accounts.

It’s a critical international scam. The Brazilian government says that in 2001, its companies exported $175 million worth of goods to the Caribbean island of St. Lucia, $123 million in goods to Cayman Islands, and $105 million in goods to Panama. Those tiny markets didn’t absorb the cargoes; they were just transfer-pricing way stations.

Why are developing countries in hock to the West in a way that lets the IMF and World Bank enforce neoliberalism, privatizing water, setting fees for schools and health care? Because the offshore system insures they can‘t collect taxes. Loans to dictators who stash the money offshore –in some of the same international banks that made the loans — dig a deeper hole they can never climb out of. There‘s just more loans and orders from the West. The system steals billions from developing countries – much more than the $50 billion they get in aid.

Tax cuts for the rich are only part of the way you please big-money constituents. The real tax break is the wink at offshore tax evasion.

Individuals make use of Private Banking – investment accounts set up offshore where they can hide the profits from home country tax authorities. The fact that they are offshore is often a ruse: they may be managed by computer from the bank that arranged the deal, in NY or London or Frankfurt. Banks make profits of over 20 percent on offshore accounts, twice as high as onshore.

A whistleblower from Citibank Spain gave me documents that showed Citibank there was handling accounts for rich clients, supposedly offshore, but running them from Madrid. Citibank was accounting for them in an inside double accounting system. Spanish law enforcement hasn’t gone after them for this. Is Citibank doing it elsewhere? Probably.

Secrecy havens according to Merrill Lynch & Gemini Consulting’s World Wealth Report, hold a third of the wealth of the world’s high net-worth individuals. Half is in deposits in tax haven banks and the rest is in securities held by shell companies and trusts.

Approximately $11.5 trillion of assets are held offshore by high net-worth individuals, or about a third of the total global GDP. The annual income that these assets might be expected to earn amounts to $860 billion annually. The tax not paid as a result of these funds being held offshore would exceed $255 billion a year.

Those unpaid taxes can buy a lot of politicians.

This is the dirty little secret of globalization: the end of controls on capital flows and the expansion of the tax haven system from 25 years ago to where it has more than doubled to about 70 tax havens.

The system is a major reason for the growing inequality in the U.S. and between the West and the developing worlds.

The system has given the big banks and corporations and the super-rich mountains of hidden cash they use to control our political systems.

So why isn‘t the progressive movement doing something about this? This is a case where some people in Congress are ahead of the activists. There are a handful of Democrats like Senators Levin (MI), Dorgan (ND) and Conrad (ND), like Rep. Doggett (TX), who are speaking out and introducing legislation. But there is no movement behind them. And while Obama has signed onto the Levin Stop Tax Haven Abuse Act, Clinton, Biden and Dodd have not.

Strategies

The Tax Justice Network-USA is the American branch of the international TJN,  started at the world social forum in Porto Alegre in 2003 mostly by European development groups as well as people from Attac. Our national steering committee includes people representing or on the staffs of ADA, AFSCME, the Teamsters, the Center for American Progress, OMB Watch, New Rules for Global Finance, Friends of the Earth and Public Citizen. But that’s a small number.

started at the world social forum in Porto Alegre in 2003 mostly by European development groups as well as people from Attac. Our national steering committee includes people representing or on the staffs of ADA, AFSCME, the Teamsters, the Center for American Progress, OMB Watch, New Rules for Global Finance, Friends of the Earth and Public Citizen. But that’s a small number.

We need to build a movement including many of the organizations here to raise the consciousness of the left and the general public about what is going on. Because they don’t know. Because the mainstream media doesn’t tell them. Even groups seeking money for social programs – health, housing, education – don’t seem to realize that spending money depends on getting money and that getting is blocked by the offshore tax evasion system. People have told me it’s not our issue.’Well, when your programs get cut by Congress because it says there’s no money, it is your issue.

It’s also an issue for middle class people who complain about property and sales taxes. We need to tell them those taxes are high because the government can’t collect income taxes from corporations and the super-rich. It’s an issue for small business that’s in unfair competition with multinationals that dodge taxes through transfer pricing. It‘s a way to encompass mainstream America in our progressive movement.

First strategy: Beyond raising the awareness of the left, we need to get this on the political agenda. We need to mount support for needed legislation to be passed and to pressure the next administration to play a positive role nationally and also internationally, supporting the OECD [Organization for Economic Cooperation and Development] initiative against tax havens instead of scuttling it as Bush did.

The way to start to do that is for the organizations represented here to include statements about tax dodging (that includes illegal evasion and, till now, “legal” avoidance), in the platforms and in the demands they make to candidates, national and local. We need to make this a campaign issue.

TJN-USA is developing an issue paper and candidates‘ questionnaire on tax evasion and will send it to other civil society groups so all of us can present it, or versions of it, collectively or individually to the candidates, with a focus on the presidential candidates, and publicize the responses.

After the election, we must to continue to raise public consciousness about the need for legislation and regulatory change. Action against tax evasion should be put on the new Congress and President’s first 100 days list. The current S-681, the Levin-Coleman-Obama Stop Tax Haven Abuse bill, is a good start. It slices at the heart of the offshore system. It will die without massive public support.

The second strategy is the corporate society responsibility one. We need to get companies and shareholders to recognize that paying taxes is not a burden or a cost of doing business, it’s what companies owe the society that makes it possible for them to operate and make money. We need to add to the boilerplates of socially responsible investment funds, and government and union pension funds standards banning corporate tax dodging and, for banks, bans on enabling tax dodging. We need to use shareholder action and publicity to force corporations to deal with those demands.

The Teamsters, whose pension fund has Citigroup stock, got TJN a proxy to Citigroup‘s annual shareholders meeting last year and I and the Teamster rep spoke on the issue. This year, a priest involved with shareholder action got 14 Catholic groups to sponsor shareholders resolutions for the proxies of Citigroup,![]() JP Morgan Chase

JP Morgan Chase![]() and Bank

and Bank  of America that said: Be it resolved that the shareholders request the Board of Directors to prepare a report for shareholders about the policies that are in place to safeguard against the provision of any financial services for any corporate or individual clients that enables capital flight and results in tax avoidance. Of course, the banks refused to put this on the proxies, and the SEC backed them up.

of America that said: Be it resolved that the shareholders request the Board of Directors to prepare a report for shareholders about the policies that are in place to safeguard against the provision of any financial services for any corporate or individual clients that enables capital flight and results in tax avoidance. Of course, the banks refused to put this on the proxies, and the SEC backed them up.

We need to have people to expand this campaign to all the major corporations. Corporations put aside millions of dollars to pay taxes if their manipulations are ruled illegal. They know they are illegal; the issue is only will they be caught. We need to have people propose shareholder resolutions and speak at annual shareholder meetings against tax dodging because getting caught could be expensive.

A third part of the strategy is research: we need help from university professors and students and others to investigate and publicize the tax-evading practices of corporations. Anyone reading SEC statements would have known that Enron had over 700 shell companies in Grand Cayman. What were they for? Why didn’t analysts expose that? We need to make a national tax dodgers hall of shame, similar to what Citizen Works has done for the corporate inverters — including Accenture and PwC Consulting, Global Crossing, Tyco International , Ingersoll-Rand , Seagate Technology, Fruit of the Loom and Carnival Corporation — who moved their headquarters offshore.

We need a website where information about the offshore and tax manipulations of corporations can be posted and to which many groups link. So when people search for the corporation‘s name on the internet, they find it.

The Rainforest Network found it a good tactic to dog corporate bigwigs who are making speeches, getting awards — to be there with leaflets exposing the exec‘s company’s tax dodging. Corporate execs hate that. But for that, again, we need the research into offshore subsidiaries and tax payments.

Finally, there is a major problem in the person of Robert Rubin, who has positioned himself to be the financial eminence grise behind the Democrats, particularly Clinton and Obama. He is Mr. Teflon. The press loves him; he is so urbane. He is dangerous. Let me give an example. Correspondence accounts are accounts banks have in banks in other countries so they can move clients‘ money there. Fake banks, shell banks with no bricks and mortar, used correspondence accounts to move illicit money through U.S. banks.

When Sen. Levin finally got a ban on correspondence banking by shell banks  written into the Patriot Act – after Dick Armey and Phil Gramm had blocked it for years at the behest of the Texas bankers who didn‘t want to stop the inflow of Mexican drug money — it was Citigroup under Rubin that was the major lobbying force on the Hill against it. It passed because Osama bin Laden had used a shell bank to move money. We don‘t want Rubin anywhere near a Democratic administration.

written into the Patriot Act – after Dick Armey and Phil Gramm had blocked it for years at the behest of the Texas bankers who didn‘t want to stop the inflow of Mexican drug money — it was Citigroup under Rubin that was the major lobbying force on the Hill against it. It passed because Osama bin Laden had used a shell bank to move money. We don‘t want Rubin anywhere near a Democratic administration.

I invite you to take up this issue, to get involved in these projects through your organizations independently or with Tax Justice Network-USA, as individuals, as interns. Our website is taxjustice-usa.org/. You can sign on to an email list there. Tell me if you want to be part of the network and if you want to work on projects aimed at ending corporate tax evasion.

Let’s get the country to tell the corporations that the taxes they are dodging are our money!

*Comparison of the Reported Tax Liabilities of Foreign-and U.S.-Controlled Corporations, 1996-2000, General Accounting Office, GAO-04-358

Dear Ms Komisar: I now fully grasp your concern and eagerness to expose the corruption of offshore tax havens which must have on their books the multi trillions in the aforementioned investigation.

Allow me to further your argument by suggesting that the oligarchy of corporate/governmental individuals has locked into place a media blackout of any sane investigative reporting on this issue. Mostly because the “hidden” funds are perpetuating the global economy as it is (the recent $400 billion injection of FED and other central bank money and the lowering by 1/2% the prime rate).

As you must be well aware. Average listeners/readers/viewers of the explanations of the “facts” behind the lack of money for domestic/foreign aid programs etc. are in my view purposely blinded to accept the “government line” (“that the Iraq war is consuming all the available funds”).

I feel you are fighting the good fight; yet you/we must always realize as we did during the chaos of the 60’s anti Viet Nam war protest era that our pleas for peace were falling on deaf ears. The academic mood across the nation today is stifled. So much is invested in maintaining this feudal style 21st century eco-political/economic dictatorship that even if Michael Moore were to take up the charge and compose a film exposing this atrocity I am not certain that anyone viewing his film would know what/how to react.

Also one must ask whether this is being completely engineered to bring a halt to the daily neighborhood economies of the west in order to bring about a “new form” of feudal dictatorship? In that case all countervailing efforts will be forcefully hushed from above. Economic covert warfare has been an age old tool to transfer power from one group to another (see The formation of the FED; crowning of Charles I of England; who was Charles III of Scotland; or the Rothschild’s pigeon news report after Waterloo; or Mr. Soros’ attack on the British pound).

Clearly we are under an oligarchy of Bush-Clinton-Bush-Clinton (again?) criminal crime families. This may be no mistake.The amount of money accessible to those surrounding the center of federal government (K street lobbyists, etc.) have such a stranglehold on this nation that until we throw off the cult of personality and lavish lifestyles we may never see that the rising tide raises all boats (or as Mr. Sen McCain put it: “all yachts”).

I recently heard that the Greeks had another more powerful word to explain the “rule by scoundrels” (I’m afraid I don’t remember the Greek word for it). Regardless that is the functional definition of our so called democracy today.

I apologize if this comment seems cynical but I have survived a time in federal prison where one develops this attitude. I hope you rationally fight the good fight and as they have all the guns; and further that you are successful in exposing their greed and corruption in a way to bring awareness to the multitudes (even if you inform only their corporate stockholders).

Thanks

Richard Gordon CP

I have long argued that the corporate income tax, in the USA for sure, and most likely in other countries as well, is in effect a voluntary tax: if you don’t want to pay it, your accountants, with the help of ludicrous transfer pricing shell games and of willing offshore banks, can turn your USA tax liability into a Cheshire Cat’s grin.

The USA national income accounts reveal a historical ratchet pattern. Every 15-25 years, Congress gets tough, closes some loopholes, and corporate income taxes as a fraction of GDP rises. But then that fraction gradually erodes, until the next burst of Congressional indignation. Over the past several

years, the fraction has been fairly high when compared to the 80s and 90s. But I very much doubt the problem has been eliminated.

I was taught in the 70s that national tax authorities are no match for multinational corporations and their Big Four tax advisors. And that the cunning of multinational business far outstrips tax law and accounting practice. What to do? I am not sure, but suggest the following:

1. The European Union, Switzerland, NAFTA, the Asian Tigers, Australasia, should negotiate a multi-lateral agreement on the taxation of the income from capital and on transfer pricing. This addresses the tax havens in Luxembourg, Switzerland, Monaco, Channel Islands, Isle of Man, Bahamas, Cayman Islands, and possibly more.

2. The European Union should consider adopting a common union-wide corporate income tax law.

3. Most radical of all, nations should adopt a form of the Hall-Rabushka Flat Tax. Warning: that tax has been oversold, in particular a flat rate of 19% won’t do the job, and the Flat Tax should be integrated with Social Security. Hence the required flat rate is more like 30%. The harshness of the tax for modest incomes would be offset by a payment of $250-$300/month to every legal resident of the USA. It would still be advantageous to sell to offshore subs at artificially low prices, and to buy from such subs at artificially high prices. This problem requires further thought.

4. Under a flat tax, the responsibility for paying income tax on interest paid by businesses could be placed on the borrower instead of the lender. Under such a system, there would be no incentive to channel bank credit and debenture ownership through shell companies in tax havens.

I am not sure just what will address the problems you rightly raise. But something must be done.

I’m a new reader from across the water in England and I an fascinated by the content. I am amazed to find out what is going on in your excellent pieces, – articles and interviews. It certainly is an eye opener. I wanted to raise a few questions if I may.

I believe the situation with laundered drug money is as bad as you say, $500 billion a year at best guess. Can you explain why the FATF have so few offshore centres on their “Non Compliance” warning list ?

A large number of these centres will be involved in the laundering of massive amounts of drug money, so how do they lure the FATF into stating that they are complying with the process of identifying money launderers ?

Is it because monies held in corporate accounts are exempt from regulations ? Is it because banks run and owned by criminals – state they are complying with the regs and reporting suspicious customers, – but in reality, – just don’t?

Is the FATF just an exercise in publicity where as in reality it is the interests of Wall Street and the City of London which are being safeguarded ?

This seems a lot of questions !! Well. I expect you are very busy. But keep up the good work. I look forward to reading more.

Paul Jeffery

[ed: FATF is the Financial Action Task Force, set up by Western governments to address money-laundering. It has few powers other than “name and shame.” ]

Pingback: Anonymous

Lucy

Your article is excellent. I only recently became aware of the staggering amounts of money involved in tax evasion, because of a documentary about it on TV in England last year in which the Tax Justice Network was mentioned. I proceeded to access their website and read the information on it and have passed it on to some of my other ‘socially’ aware friends.

The problem of tax evasion is thankfully being increasingly mentioned in political debates that I have listened to recently and last weekend we had protestors in the UK forcing Barclays to close some of their Saturday opening banks when they protested over the pitiful amount of Corporation Tax Barclays paid last year, after it was published in the press.

It will, however, take concerted international ‘pressure’ by the public to change ‘the tax system’ into a fairer one – one can only hope.