Blog, Offshore

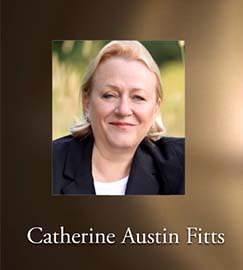

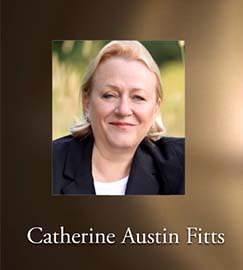

By Catherine Austin Fitts, The Solari Report, Feb 6, 2020 – Lucy Komisar is an investigative reporter”she publishes The Komisar Scoop. Lucy is my go to person for questions about complex financial frauds, particularly when they involve tax evasion and the offshore haven system.

Blog, Offshore, Reporting

July 22, 2019 – Robert Morgenthau, who was the District Attorney of Manhattan for 33 years, died today at 99. He was a mortal enemy of the corrupt offshore bank and corporate secrecy system and used the fact of dollars settling in Manhattan banks to go after money-launderers throughout the world.

Offshore, The Browder Hoax

March 17, 2018 – Bill Browder must be shedding tears that Mossack Fonseca, the infamous firm that set up offshore shell companies to help tax-evaders, criminals, looting dictators and other money-launderers, is shutting down.

It says it did so because it got a bad rep from the Panama Papers exposé.

Blog, Offshore, Reporting

June 3, 2016 – Joseph Stiglitz, Nobel prize-winning former chief economist of the World Bank, says that the way to solve corruption and money-laundering facilitated by offshore banks that run secret accounts is to “shut them down.” And the way to do that is to ban non-transparent banks from US correspondent accounts. He spoke at a Council on Foreign Relations meeting today.

At the breakfast on “Is U.S. Finance Hurting Growth?”, he addressed an aspect of banking that was not on the agenda, asking, “Why do we have offshore banking?

Offshore, Scoops, Tax Evasion

The American Interest, May 12, 2016 – Solving the offshore money-laundering and tax evasion system is easy, but the Obama Administration‘s proposal isn‘t the way to do it.

Stung by the Panama Papers revelations of worldwide tax evasion by the rich and powerful, President Obama has seized the moment to propose a solution guaranteed to gather headlines”and then fail. But if he wanted to, he could, through the Treasury Department, end the system of offshore tax havens with a stroke of the pen.

First, let‘s look at the solution and, then, at what‘s wrong with the President‘s proposal.

The Obama proposal acknowledges the threat offshoring poses to our national security. Treasury estimates that $300 billion in illicit proceeds are generated annually in the United States due to financial crimes. But it then essentially ignores the powerful weapon it can wield against that threat.

Blog, Corporate Abuses, Offshore

Jan 15, 2015 – Anne Applebaum wrote an article about Putin’s Russia in the Dec. 18, 2014 issue of the New York Review of Books that was filled with distortions. When I saw NYRB editor Robert Silvers at a Dissent magazine party in New York Dec. 5th, I told him my opinion. He said to send him my comments. But then he declined to print those comments and said that he would run this editorial statement:

Lucy Komisar has written to us that she has a statement to make about the article by Anne Applebaum in our December 18, 2014 issue. This statement is available on her website, The Komisar Scoop. ” The Editors.

Blog, Corporate Abuses, Offshore

Jan 24, 2011 – The lawsuit filed by a former employee against the Newark-based global telecom IDT is over. J. Michael Jewett, who was an IDT executive, claimed in 2004 that he was fired for opposing bribes to Haitian officials. Lawyers for both sides agreed to drop the complaint and counterclaims in an accord filed with the U.S. District Court in Newark on January 13th. This has not been reported before now.

IDT spokesman Bill Ulrey said, We have no comment…as usual. Thank you. Jewett’s attorney William Perniciaro also declined to discuss the matter. When both sides don‘t talk about an agreement to dismiss a case, that normally means a confidential settlement has been reached.

Offshore, Regulation & enforcement, Scoops

The American Interest, Jan-Feb 2011 (online Dec 9, 2010)

Corporate secrecy, which involves hiding the identities of company owners from tax and other legal authorities, is itself no secret. It is well known that offshore banking centers such as Switzerland, Liechtenstein and the Cayman Islands have for many years enabled fraudsters all over the world to carry out scams, launder illicit profits, stash stolen loot and hide money from tax authorities.

What most people do not know, however, is that there is a vast and growing American offshore. Foreign crooks prize states such as Nevada, Wyoming and especially Delaware for state laws that don‘t require them to list owners or even company officials when a new company is formed. Corporate interests and the Obama administration are blocking congressional efforts to change that.

Blog, Offshore

Sept 27, 2010 –

China is the major international power blocking a global solution to the offshore bank and secrecy problem. It is doing so because of its own secrecy jurisdiction, Hong Kong, says José Manuel Barroso, the president of the European Commission.

He said some countries hadn‘t been reacting positively to efforts to change the system , to establish a level playing field.

After the meeting, I asked him why the major financial powers hadn’t been able to achieve a solution. He said the problem was China, because of Hong Kong.

Featured, Major Past Articles, Offshore, Regulation & enforcement, Scoops

Barron’s, Sept 20, 2010 –

Scoop summary: Howard Jonas, CEO of U.S. telecom IDT, in an interview with Lucy Komisar, acknowledges for the first time that then Haiti President Jean-Bertrand Aristide in 2003 met with an IDT official during discussions about a contract to pay Haiti Teleco for calls from U.S. customers. That contract included agreement for IDT to send payments to a shell company in the offshore Turks and Caicos Islands. Jonas said IDT got an ethics letter from a law firm clearing the deal, but the lawyer said in a memo filed with the court, published here for the first time, that he simply told IDT to do due diligence. IDT signed the contract the next day.

A former IDT official, who objected to the deal, was fired and is suing the company; trial is set for Nov 9th. The Justice Department and Securities and Exchange Commission are investigating violation of the Foreign Corrupt Practices Act. Jonas’s revelations are likely to have a major impact in the trial and investigations.

Banks, Corporate Abuses, Featured, Offshore, Scoops

The American Interest, July-Aug 2010 (online May 18, 2010) –

As I write this, the U.S. Senate is debating a major financial reform bill in which the credit default swap, a kind of derivative, plays a significant part. An amendment to that bill, proposed by Senators Carl Levin (D-MI) and Jeff Merkley (D-OR), would ban banks from proprietary trading. There are a lot of high-rolling bankers who do not want that amendment to pass, because it will mess up their plans to repatriate foreign profits into the United States, untaxed, by trading in derivatives on their own accounts. The clearinghouse ICE Trust U.S. forms a central part of these plans.

What is ICE Trust U.S., and who owns it? ICE US Holding Co., which was established in 2008 as the parent of ICE Trust U.S., is located in the Cayman Islands. Yet none of the owners of ICE US Holding Co. are based in the Caymans. Among the owners of the Cayman‘s company are Citigroup, Goldman Sachs, J.P. Morgan, Merrill Lynch and Morgan Stanley, which are headquartered in New York. Bank of America, which now owns Merrill Lynch, is based in Charlotte, North Carolina.

Banks, Offshore, Regulation & enforcement, Scoops

Inter Press Service (IPS), Feb 3, 2010 –

The global bank HSBC may be running offshore accounts for central banks. According to a U.S. Senate investigation, an HSBC subsidiary in London called HSBC Equator Bank had a sister bank in the Bahamas.

According to an internal e-mail, the bank told HSBC USA it had been providing offshore accounts to central banks for 20 years, because the banks wanted to avoid Mareva injunctions, legally enforceable orders to freeze funds.

Featured, Major Past Articles, Offshore, Regulation & enforcement, Scoops

State aided suspect in huge swindle

Miami Herald, July 5, 2009 –

Winner of the Gerald Loeb award, the most important prize in financial journalism

Years before his banking empire was shut down in a massive fraud case, Allen Stanford swept into Florida with a bold plan: entice Latin Americans to pour millions into his ventures ” in secrecy.

From a bayfront office in Miami in 1998, he planned to sell investments to customers and send their money to Antigua.

But to pull it off, he needed unprecedented help from an unlikely ally: The state of Florida would have to grant him the right to move vast amounts of money offshore ” without reporting a penny to regulators. He got it.

Offshore, Regulation & enforcement, Scoops

Inter Press Service (IPS), May 8, 2009

– Jeffrey Owens, the tax point person of the Organisation for Economic Cooperation and Development (OECD), was stung by activist critics of the OECD standards under which countries will be put on a tax haven blacklist and targeted for sanctions.

The blacklist was announced last month at the London meeting of the G20, which said in a communiqué that it would take action against non-cooperative jurisdictions, including tax havens…to deploy sanctions to protect our public finances and financial systems.

Key civil society criticisms are that the OECD standards require bilateral agreements for information on request, not automatic multilateral tax information exchange; that they call for only 12 such agreements to be signed by each tax haven; and that getting off the blacklist entails only promises, which have not been kept by tax havens in the past.

Offshore, Regulation & enforcement, Scoops

Inter Press Service (IPS), April 30, 2009 – The U.S. Internal Revenue Service (IRS) is hitting pay dirt with a novel legal tactic designed to catch tax evaders. And it’s going to use it to force international banks to give up the names of tax cheats. It’s called the John Doe summons. Using John Doe means the IRS doesn’t know the names of the suspected tax evaders. So it sends a summons to a bank or credit card company that says, Give us the names and account information of all your U.S. clients with secret offshore accounts. Daniel Reeves, an IRS agent in charge of the tax agency’s offshore compliance initiative, afforded an unusual look into the broad swath of projects that seek tax-cheating John Doe’s every place from accounts of the giant Swiss bank UBS to the records of Pay Pal.

Offshore, Regulation & enforcement, Scoops

Inter Press Service (IPS), March 29, 2009 –

This could be the moment when a fatal blow is delivered to the world’s tax havens. Or it could be another largely cosmetic change that allows offshore financial centres such as Switzerland, the Cayman Islands and Liechtenstein to deflect attacks on the system by sacrificing the few tax miscreants that governments catch in their nets.

Decisions at the G20 government leaders meeting in London Apr. 2 will set the direction.

Offshore centres, worried what may happen in London, are falling all over themselves promising to cooperate with the major powers on the trail of tax cheats. But the holes in the tax havens’ promises are as big as those in Switzerland’s famous cheese.

Many believe that automatic exchange of information is the only really effective way to end pandemic tax evasion. Some very good proposals are made in a leaked French paper which is linked to the full story.

Corporate Abuses, Major Past Articles, Offshore, Scoops

AlterNet, March 26, 2009 –

Congress has deftly avoided the real story of AIG’s collapse, which will make a few million in bonuses seem like peanuts.

Most legislators at a House Finance subcommittee hearing last week deftly avoided the real story of AIG’s collapse. Instead, they homed in on the public relations disaster of hundreds of top AIG officials and staff getting $165 million (later revealed as over $218 million) in bonuses.

The key issue ignored by the congressmen and women was the potential catastrophe represented by as much as $2.7 trillion in AIG derivative contracts and how AIG and the U.S. government are dealing with them. To put that number in context, we’ve so far provided the company only about $170 billion.

Blog, Offshore, Regulation & enforcement

Feb 11, 2009 –

The U.S. government might finally get a powerful tool against offshore tax evasion by mega-wealthy individuals and corporations. The worst most miscreants face now is negotiated pay-ups years after they are caught.

A bill introduced last week by Senators Patrick Leahy (D-Vermont) and Chuck Grassley (R-Iowa) would make tax evasion using international transfers a criminal money-laundering offense.

The law aims at cases in which money passes through tax havens. It targets not just the evaded taxes, but any money that is part of the scam.

Corporate Abuses, Offshore, Scoops

Inter Press Service (IPS), Feb 5, 2009 –

President Barack Obama said he would crack down on firms that use offshore centres to evade taxes. He could begin with a New York subsidiary of one of the world’s largest private banks, which used a Cayman Islands company to shift its profits.

Why would a New York investment fund manager run operations through an office in the Caymans? This type of structure is for optimising taxes, explained Max Obrist, a Cayman Islands official of the global Julius Baer Group (Zurich).

He told IPS that generating the income where a company was actually based, you would pay much more taxes. Obrist was describing a company shifting claimed earnings to tax havens to evade home taxes. He allegedly helped Julius Baer Investment Management (JBIM) New York do just that.

Corporate Abuses, Offshore, Scoops

Evening Standard (London), Jan 6, 2009

Gordon Brown and Barack Obama are both promising to crack down on the use of offshore tax havens. But putting those tough words into practice is another matter.

One of the world’s biggest private wealth management groups circulates funds via offices in the Cayman Islands, claiming they take major investment decisions ” when the main work is apparently carried out in London.

With offices in London and across the globe, Swiss-based Julius Baer banking group invests over $300 billion ( £208 billion) in assets on behalf of institutions and wealthy individuals. Profits in 2007 were more than $1.1 billion.

In London, one of its units was known as Julius Baer Investors or Julius Baer Investment Management (JBIM) until a management buyout in 2007. It was renamed Augustus Asset Managers, is based in Bevis Marks in the City, and is still 10% owned by Julius Baer.

From London, Augustus controls assets of $12 billion but claims its profits are generated elsewhere, offshore at a Cayman Islands Baer subsidiary called Baer Select Management.

Why? Simple, really. “If you would generate all the income in London, you would pay much more taxes,” acknowledged Max Obrist, a Cayman Islands executive of Julius Baer.

Offshore, Regulation & enforcement, Scoops

Inter Press Service (IPS), Dec 22, 2008

The financial crisis has the U.S. swirling with charges about the immoral greed of some corporate executives who recklessly bet their companies’ futures to line their own pockets. The popular fix for this international calamity stops at the nation’s borders: decouple top-line salaries and bonuses from stock prices and institute more transparency and regulation.

However, last month, the Vatican, in a groundbreaking statement, linked the financial crisis to a much deeper problem largely ignored in discussions of the crisis here. It underlined the need to consider carefully the hidden but crucial role of the offshore financial system in light of the emergence of the global financial crisis.

The Vatican now gets it, but U.S. corporations don’t. The U.S.-based multinationals that signed on to yet another ethics pledge included General Electric, The Hartford, Pepsi, Wal-Mart, Accenture, Dell, and United Airlines. Their ethics, according to their pledge, does not include rejecting the use of the offshore system to evade regulation as well as taxes.

Major Past Articles, Offshore, Scoops

Inter Press Service (IPS) Dec 19, 2008

American International Group (AIG) operated a captive insurance scam that involved fraudulent use of offshore tax havens. Currently, the U.S. government has invested over $40 billion in AIG, with the U.S. getting nearly 80 percent of its stock.

This puts the U.S. in a unique position to investigate the internal operations of a giant corporation with a reputation for using the offshore system for tax evasion.

U.S. authorities could begin their investigations with a look into a very curious practice that was revealed 15 years ago in a case that was never exposed by the mainstream press and which insurance insiders say is endemic.

AIG would keep a portion of a client’s inflated insurance premium and send the rest to the client’s offshore reinsurance company. AIG would earn a higher commission. The client would write off the entire amount as a business expense and enjoy the extra cash offshore, tax free.

This story tells how notorious fraudster Victor Posner made an AIG deal to stash reinsurance profits in Bermuda.

Offshore, Regulation & enforcement, Scoops

Inter Press Service (IPS), July 18, 2008

It sounded like the plot of an action thriller. A U.S. Senate subcommittee held hearings Thursday on how UBS/Switzerland, the world’s largest private bank, and LGT (Liechtenstein Global Trust), owned by the royal family of that micro-tax-haven state, organised complex tax evasion schemes for U.S. clients, and used spy-type tactics to avoid being detected.

LGT bankers allegedly used code names and public phones instead of making calls that could be traced. UBS agents carried encrypted laptops and business cards that didn’t mention they were in the wealth management division. According to testimony and records, both banks took care to disguise their activities because moving and hiding the money of tax evaders and other criminals is very lucrative, bringing hundreds of millions of dollars in profits.

Offshore, Regulation & enforcement, Scoops, Tax Evasion

Condé-Nast Portfolio, July 16, 2008 –  Code names, secretive European royalty, encrypted computers. A spy novel? Nope. Nope. It’s how two European banks helped rich Americans duck the taxman, a Senate probe found.

Code names, secretive European royalty, encrypted computers. A spy novel? Nope. Nope. It’s how two European banks helped rich Americans duck the taxman, a Senate probe found.

The Newport regatta has always drawn America’s moneyed class, and the Art Basel show in Miami is hot on the nouveau riche circuit”making both glitzy venues ideal for financial giants to prospect for new clients.

But UBS, one of the world’s largest banks, had another goal in mind when it shelled out money for the UBS Regatta Cup in Newport or the Art Basel Art Fair in Miami, or performances in major U.S. cities by the UBS Vervier Orchestra.

Offshore, Scoops

Condé Nast Portfolio, July 15, 2008

Jim Courter, one of Senator John McCain’s top fundraisers, has resigned from the McCain campaign just days after Lucy Komisar reported on portfolio.com that Courter’s company had been fined by regulators.

The Federal Communications Commission last week levied a fine of $1.3 million against IDT, a New Jersey telecommunications company headed by Courter, for failing to disclose its 2003-04 long-distance phone agreements with Haiti.

Code names, secretive European royalty, encrypted computers. A spy novel? Nope. Nope. It’s how two European banks helped rich Americans duck the taxman, a Senate probe found.

Code names, secretive European royalty, encrypted computers. A spy novel? Nope. Nope. It’s how two European banks helped rich Americans duck the taxman, a Senate probe found.