By Lucy Komisar

Nov 2, 2018

I spoke today on the Fault Lines radio about how Mikhail Khodorkovsky and William Browder scammed Russian energy sector companies by

* MBK (Mikhail Borisovich Khodorkovsky) getting control of Yukos oil through rigged auctions in the corrupt Yeltsin regime and then using transfer-pricing to cheat minority shareholders and Russian taxpayers and

* Browder buying shares in Russian energy conglomerate Gazprom through cutout companies to evade rules that banned purchases of its stock in Russia by foreigners.

Here are the links:

The Russian government owned the company until 1995, when “oligarch” Mikhail Khodorkovsky obtained 78-percent of it for $350 million in a rigged “loans for shares” auction run by his own Menatep Bank, agent for the State Property Committee of corrupt former President Boris Yeltsin. The company was supposed to be security for “loans” that the Yeltsin government conveniently never paid back. When the shares went on the market a few years later, Yukos’ value was put at $9 billion. Massive theft.

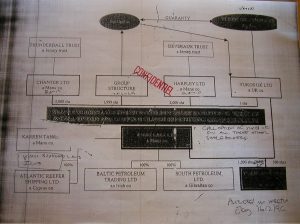

The smoking gun that points to where some of the Yukos money went is a confidential memo that shows how the company moved its profits through offshore accounts to cheat minority shareholders and the Russian government. There are charts indicating the connection between Yukos and offshore trading companies that were allegedly independent.

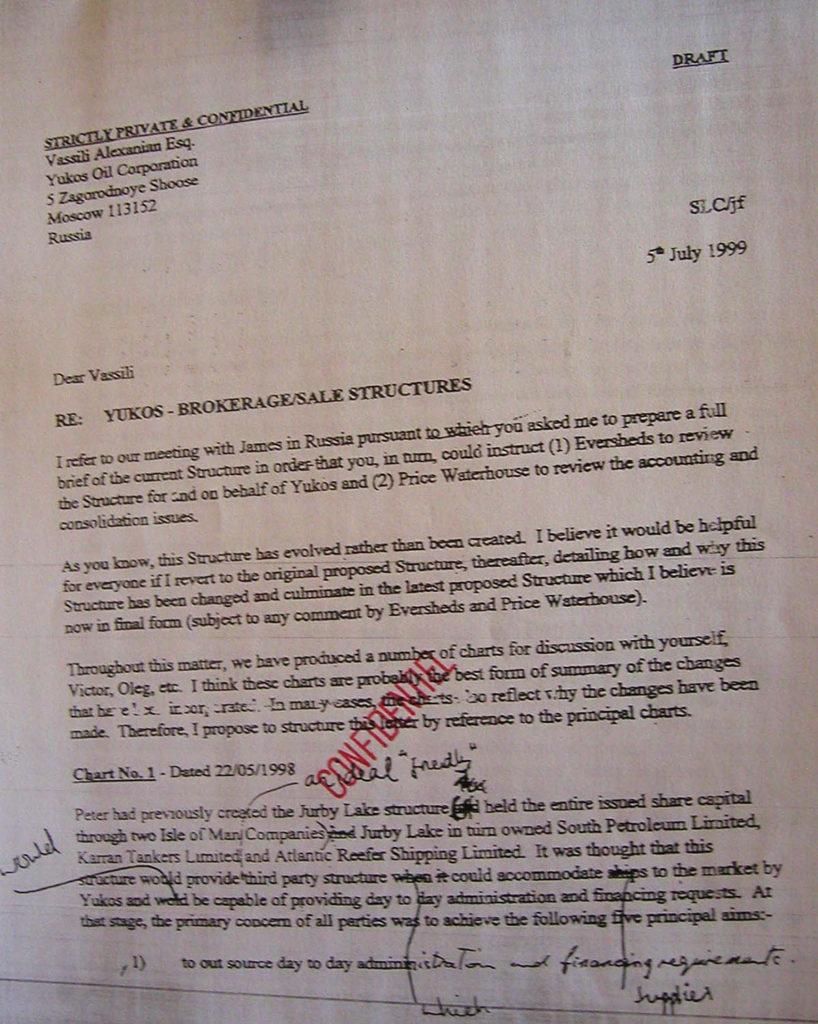

The secret document details a meeting that occurred in June 1, 1999 at 94 Park Lane, in London. Among five participants were Stephen Curtis, managing director of Group Menatep, the holding company that owned Yukos; Peter Bond, who ran Valmet, a shell company incorporator on the Isle of Man, a tax haven; marketing director Branson Bean; and two others listed as “Peter Clucas” and “JJ.”

Bond would later acknowledge in a U.S. federal court that his business involved setting up shell companies for clients to hide and move illicit money. That case involved his client Robert Brennan, an American stock swindler who in 2001 was convicted in New Jersey for bankruptcy fraud and money laundering. The Justice Department promised he would not be asked about his Russian clients.

Curtis briefed the others about Yukos marketing. He explained that Yukos oil flowed through what they called the “Jurby Lake Structure,” an offshore network they’d named after a lake in England. The structure was based on trading companies — Behles, South Petroleum and Baltic Petroleum — which Jurby controlled. Behles and Menatep shared an office at 46 rue du Rh´ne in Geneva. South was registered in Geneva and then Gibraltar, Baltic in Ireland.

The network was used for “transfer-pricing,” ie over and under-invoicing. Yukos would sell oil to Behles at below market prices, and Behles would resell it to South at market prices. The difference ($3-$4 million a month) was transferred via bank accounts at UBS in Switzerland to secret accounts on the Isle of Man.

So, the real profits from the oil sales would not appear on Yukos balance sheets, and they could be hidden from tax authorities and minority shareholders.

Russian authorities claim that Browder and his major investors after 2000, the American Ziff Brothers, illegally bought 200 million shares of Gazprom between 1997 and 2005, at a time a presidential decree banned foreigners from buying such shares. They used networks of Russian shell companies to make buys on the St. Petersburg and Moscow trading floors.

Browder and his partners, the Russian Interior Ministry alleges, used the Kalmykia shell, Kameya, to buy 200 million shares at St. Petersburg and Moscow brokerage trading floors. Kameya‘s general director was listed as Ivan Sergeevich Cherkasov, Browder‘s partner acting as a nominee.

The Russian investigators say Gazprom shares in 2006 were transferred to the Cypriot Giggs Enterprises Ltd and the profits were then shifted to companies managed by the Ziff Brothers Fund. The Interior Ministry said the shares were consolidated in Kameya, which sold some of them and sent about 70 million as dividends to Speedwagon Investors I and II.

Russian Interior Ministry investigators described the Speedwagon I and II, Cyprus and Kalmykia shell company network whose owners were Browder and the Ziffs.

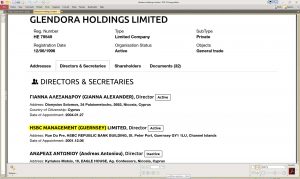

The remaining shares moved to Browder‘s Kalmykia companies, Saturn Investments, Dalnaya Steppe, and Ryland. Then they were transferred to Browder‘s Cyprus shells. Including Glendora. They ended up in Hermitage via HSBC Management (Guernsey). The ministry says that by these transactions, Russia was cheated of more than 1 billion rubles. (A ruble at the time was less than 3 U.S. cents, so nearly $30 million.)

The ministry says the Ziffs may have violated U.S. law since Ziff Brothers Investments, a tax resident of the United States, was not registered with the U.S. Securities and Exchange Commission as an investment company and thus could not participate legally in those transactions.

The General Prosecutor‘s Office conducting an investigating into the illegal acquisition of the Gazprom shares the Russian asked for U.S. Justice Department help in their investigation. They wanted data that would allow them to take the case to Russian court, though they expected that Browder would not return for trial. They thought American authorities might want to determine if the transactions adhere to U.S. financial and tax law.

They didn‘t get that help.

Cyprus

Instead, when the Russian sought help from Cypriot authorities to trace how Cyprus shell companies may have been used to move Gazprom shares out of the country, Browder took legal action to challenge their cooperation. And got members of the European Parliament to back him, to threaten Cyprus with sanctions if did the normal international judicial cooperation. At first Cypriot authorities agreed to cooperate, then suspended cooperation.

Of course, the question is what is Browder hiding? Why should he oppose looking into how he used Cyprus shell companies to move shares, especially Gazprom shares, out of Russia? Seems like the action of someone with something to cover up.

Cyprus’s final decision is awaited. We will see if Browder and his political allies can continue to finesse the international rule of law.

Pingback: Assange lawyers’ links to U.S. govt & Bill Browder raises questions – The Komisar Scoop

Pingback: Mikhail Khodorkovsky: the Man, the Myth, the Movie – The Komisar Scoop

Pingback: “Corporate Strategy in Post-Communist Russia” details Khodorkovsky’s Yukos transfer-pricing & tax cheating – The Komisar Scoop

Pingback: Assange vs Khodorkovsky: Arbitrary Application of Human Rights by British Courts - 21st Century Wire

Pingback: ASSANGE EXTRADITION: Assange Not Sick With Covid-19, But Says Many in Belmarsh Are – Niki´s Opinion Forum

Pingback: Justice Department has No Time to Prosecute Revolutionaries, Busy Burying Julian Assange – Niki´s Opinion Forum

Pingback: Comprender la naturaleza arbitraria del trato del poder judicial británico a Assange – Campaña Assange