By Lucy Komisar

May 20, 2021

My interview on Youtube tells through three dramatic stories how corrupt brokers, hedge funds and their accomplices in government and the media steal from stock market investors. It was hosted by Superstonk, the investor site started by retail buyers of GameStop whose trades pushed up the stock price and cost hedge fund short sellers billions.

The key is naked short selling, when traders sell stocks they do not own, claiming they have borrowed or located where they can borrow them, and then never deliver the shares to buyers. More shares in the market drives their price down. Short sellers plan to then buy the shares at a cheaper price and deliver them. Or often they don’t deliver them at all. They “fail.”

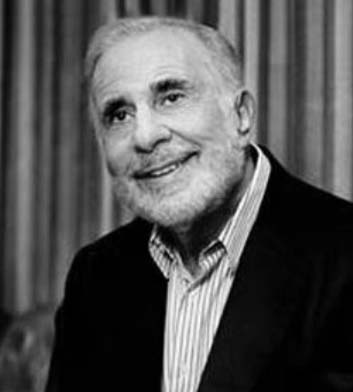

The stories involve Sedona, victim of a death spiral financing scheme enabled by New York Stock Exchange member Ladenburg Thalmann, then owned by billionaire Carl Icahn and his partner, Bennett LeBow.

Anthony Elgindy, an Egyptian fraudster who ran a message board through which hedge fund operators collaborated on short sale attacks to bring down companies. One of the members was Dan Loeb, who founded and heads Third Point, one of the world’s largest hedge funds.

Overstock, how its lawsuit against the eleven major prime dealers got internal emails that proved Goldman Sachs was working with clients to create counterfeit shares to cover naked shorts. And how Eric Holder gave it a pass when Justice Department investigators were about to charge it with corruption.

Here are key elements

The Sedona case

Sedona was a software firm based in King of Prussia, Pennsylvania, that about 20 years ago wanted to expand.

Michael Vosinkevich an investment banker at Ladenburg Thalmann, promised he could help finance their growth. Ladenburg Thalmann was owned by corporate raiders Carl Icahn and Bennett LeBow. Vasinkevich got Sedona into a $2.5 million deal in which he would locate investors and sell shares to them. The lenders would be paid back when the loans were converted to shares. The amount of shares depended on the stock price at the time of conversion. It would come to be called death spiral financing.

Sedona trusted Ladenburg. It was a prominent New York investment firm, member of the New York Stock Exchange since 1879.

And that’s where offshore and naked short selling came in. Thomas Badian and his brother Andreas, from Vienna, and their Rhino Advisors would be the intermediaries, working with an offshore fund, Amro International registered in Panama and based in Zurich, both tax havens.

Ladenburg’s investors included the Batliner Group. Herbert Batliner, according to a 1999 German intelligence document, was in the business of laundering illicit funds. U.S. prosecutors told a Colorado federal court that Batliner had handled money for a prominent Latin America drug dealer, Jorge Hugo Reyes Torres.

The contract with Amro, the fund, said “no shorting.” Short selling would push down the share price, and the less the stock was worth when it came time to convert the loan to shares, the more of the stock Amro’s “investors” would get.

But the Badians went to work. When Sedona signed the deal with Ladenburg Thalmann February 2000, the stock was trading at $6 a share. Every time the company put out good news in the summer and fall of 2000, such as a relationship with IBM that should have made stock triple in price, as soon as it started to move up, there was heavy, heavy selling through these electronic communications networks that allow the seller to hide. It would stifle the stock.

A month before the conversion took effect, Andreas Badian directed Amro’s brokers at the infamously corrupt (and now defunct) New York brokerage Refco to start selling Sedona stock short from an account at an offshore Refco affiliate. Refco had over $4 billion in some 200,000 customer accounts and was the largest broker on the Chicago Mercantile Exchange. In a month, they pushed down Sedona’s stock price to $1.01.

Badian told the brokers at Westminster, in New York, according to tapes, to “keep selling” and to use “unbridled levels of aggression,” because “every dollar of that you sell is a dollar in my pocket.” Price fell to 75 cents, then 20 cents. The Badians shares represented 40% of the trades in one month.. The conversions left Sedona still owing $1.9 million and they would have to issue more shares that would end up letting the Badians control the company.

In February of 2000, Sedona was a company of 77 employees that had obtained 65 bank customers and an IBM contract, along with $17 million in financing. When stock tanked, Sedona lost business at a dozen companies: companies don’t want to buy software if you wont be around to service it. Impossible for Sedona to get other financing except limited from own shareholders. It had to fire employees in sales and marketing

Sedona went to the SEC and Justice Department. The Justice Department charged Andreas Badian in a criminal case, but he jumped bail and is a fugitive in Vienna, Austria.

Thomas Badian and Rhino settled with the SEC for a $1-million fine without admitting or denying guilt. But the SEC did not sue Ladenburg or Batliner or Westminister or their clearing firms.

More in the video

The Elgindy case: About the collusion of media, some crooked people in the FBI & SEC, and selective prosecution.

Anthony Elgindy was an Egyptian who pretended to be Italian. He lived in San Diego and ran a subscription stock message board on the internet. He had a few hundred hedge fund members, paying him $300 to $600 a month for the privilege of being on the website talking about “who are we going to hit next week?”

Hit meant target with naked short selling. Such and such at TheStreet will publish a story on Thursday, saying this, you can get “locate” in a brokerage in Vancouver, or at Goldman.

Among the members was Dan Loeb, who founded and heads Third Point, one of the world’s largest hedge funds. He used the screen name “Mr. Pink.” a reference to a character in “Reservoir Dogs,” about a bunch of gangsters including a Mr Pink.

Elgindy had confederates inside the SEC. Elgindy would short a company, go to the SEC, get an investigation opened, the stock would fall.

A former Lehman broker who had retired to Florida got a call from fellow he haven’t heard from in 20 years, a former penny stock manipulator, Jonathan Curshen who ran Red Sea Management out of Costa Rica. He told him the stock of a internet health company he was an officer of was going to fall, be hit by a short attack. The firm was Cybercare, a new company involved in telemedicine. He told him about the Elgindy website. The attack would include articles by financial writers.

Curshen on tape to the Cybercare officer said, “We have journalists on the take.” Curshen had gone to Aruba and gotten cards you can load with money. You give $25,000 to a bank and they give you a card that someone can use at an ATM machine. “We are using these cards to pay journalists.”

With Curshen’s introduction, the former broker logged on to the website. He hired three secretaries, they sat around the clock hitting print screen every five minutes. He collected banker’s boxes of transcripts and stashed them in his garage. Dan Loeb, Mr. Pink, is on the screen shots that I have.

Elgindy’s brother was in the Muslim Brotherhood. On 9/10/2001, Elgindy called his broker at Smith Barney and told him, “Sell all my stocks, tomorrow the DOW is going to 3000. It was 9600. The next day the planes hit the buildings. A day after, his broker called the FBI. “I have a client who seems to have known about this.” They looked into it. The Lehman ex-brother gave the FBI the screen shots. So, aside from Elgindy’s Islamic connections, the FBI found out about the short selling attacks. And that he had bribed two FBI agents, who were giving him tips, ‘We are going to raid this company next Wednesday.’ He’d give them $20,000, and he’d short sell the target, put it on the message board.

Elgindy was arrested in 2002 on the financial corruption charges. He was found guilty, sentenced to 13 years in prison. The FBI couple also went to jail. None of the hundreds of brokers on the Elgindy message board was charged.

More in the video

Overstock

Elgindy paying off the media takes us into the Overstock story.

In about 2004, Overstock was targeted by naked short selling. CEO Patrick Byrne got a warning call from someone on a stock message board, not Elgindi’s. They were perhaps a precursor of Superstonk, concerned about market manipulation.

Byrne told me: “The caller said that Gradient Analytics would continue to publish outrageous information at behest of shortseller hedge fund Rocker Partners. Journalists are going to call me.” He listed reporters. “They will write hatchet jobs on Overstock. The same information that ends up in The Wall Street Journal, would soon get into the hands of reporters at Fortune, Forbes, Barron’s, TheStreet.com and Market Watch.com – all of whom would call in coming weeks. Your short interest will skyrocket.” Short interest is shares that have been sold short but not covered.

2 “You will come under federal investigation; these people are wired into the federal government.”

3 “You will see the stock appear on small foreign exchanges like Munich, Hong Kong, Singapore, without Overstock’s authorization, making it easier for hedge funds to sell phantom stock.”

4 And he predicted that Overstock would appear on the SEC’s Reg SHO list of naked short selling victim companies, the threshold list scheduled to appear for the first time in January, 2005

Every one of his predictions came true. Stories in the financial press. Investigations by Federal Trade Commission and SEC.

Byrne was learning about other companies on the Reg SHO list being shorted. They had the same small group of journalists attacking them.

Byrne said, “There was incredible similarity, a coincidence of time between lawsuits, federal actions, stories by same reporters and enormous spikes in failures to deliver. There were patterns. Somebody seemed to know about it in advance.”

(2005) Byrne took his information to the SEC. Mark Fickes of the SEC San Francisco office started investigating reporters for their role in the criminal targeting of Overstock. But the financial press got to SEC Commissioner Chris Cox, who cancelled the subpoenas.

Another player in the schemes was law firm Milberg Weiss. It hired shills to sell short targeted companies. The companies would be attacked. When they declined in value, the law firm would sue them in the names of the shills.

In 2006, the SEC filed a lawsuit and the Justice Department indicted Milberg Weiss, saying it paid plaintiffs to purchase securities. They would be told buy stock in a particular company, and months later, the stock craters. How did they know? The only charge was that it was illegal to use shill plaintiffs. The 8th largest law firm in the country melted down. Two lawyers went to prison. Why not others in the scheme?

In the charges against Goldman, Overstock said it pursued “a strategy of purchasing conversions from market makers” (who have to buy and sell shares of the stock they make a market in). The conversions used a mix of wash trades of options and stocks to create inventory for stock lending at below market rates. A wash trade occurs when a buy and sell cancel each other out.

Four years later, when the case finally got to deposition, Marc Cohodes, the managing partner of the $1.5-billion Copper River Partners (called Rocker Partners till David Rocker left), then one of the Goldman’s largest short-selling hedge fund clients, described how the options conversion trades created counterfeit shares.

The Overstock suit said conversions were bought by prime brokers and used to acquire or invent a long stock that the broker could loan out, receive significant fees from the borrowers, and even sell, as if they were real, because they were real on their books.

Goldman settled with Overstock in 2015, paying the company $20 million.

Byrne got subpoenaed to turn over to the Justice Department evidence he got in discovery. He said, “I know the FBI had an indictment drafted against Goldman Sachs, we had all the data. We spent $20 million on discovery to get these guys. There were agents working three years on this. They went to Eric Holder and he refused to sign it. A week later he goes before Congress and says there are some companies too big to fail.”

More in the video

See the full stories in the video.

Here is Part 1 of the transcript. Scroll down to “Introductions.”

Here is Part 2. And Part 3.

Fantastic work. You are inspiring for future journalists!

Thank you, Lucy, for your courage in trying to reveal the breadth and depth of the corruption within our markets. If, I, as a middle aged housewife, can become one of the silent army of “apes” and desirous of learning more about the complex machinery that is our financial system, we shall certainly see that army grow. Keep it up. The looting of companies and their shareholder’s investment is not without grave danger to our country and society in general. The theft must stop.

Thank you, thank you, thank you.

Terry

These articles leave chills on the spine.

Excellent article, as per usual.

It is truly devastating, how the laws and regulations meant to protect the average joe, have reached a stagnant state.

The only way to weed out corruption on Wallstreet, is to put the average joe in charge of it.

Looking forward to your next scoop!

-AWT

So this is why they suddenly became “too big to fail,” because they were going to be exposed. Holy shit! The corruption knows no bounds.

Wonderful post Lucy, I wish there were more people like you out there. There will be more support coming your way, I’m so grateful for your integrity.

Wonderful article. In the AMA, you briefly mentioned “Hard Locate” and Ted Kaufman. I’m curious if you have any stories to elaborate on the hard locate concept and your perspective on why hard locate failed.

Thank you for all your work and the AMA!

LK: Re hard locate and Ted Kaufman, Jeff Connaughton details that in his book “The Payoff.” I talk about it here: https://prospect.org/power/gamestop-mess-exposes-the-naked-short-selling-scam/

Thank you for this value information about naked shorting and corruption in the stock market.

Three examples from the past., It is ongoing here and now; hundreds of companies and stocks are being manipulated and attacked. This pure greed is the cancer of US stock markets. It is financial terrorism – A continious attack on civil targets. Still, regulating nstitutions are not able to stop these practices, due to in-deep intertwined financial and political interests. Money is power

Thank you for this!

Love the work you’ve been doing in exposing these illegal practises by institutional investors! Your work is highly undervalued. much love!

Lucy your work is so informative and eye-opening. Thank you for sharing!

Thank you for your integrity

Omg! Eric Holder, wtf is wrong with you? Why pull punchs? Why back that “too big to fail” play? Ugh. Really awful. Concise summaries. Max salient features of story brought together in forceful way. Very effective piece.

Would just like to let you know that your work and effort is appreciated

Well done!!

Excellent work!!! Thanks a lot

Pingback: Special Solari Report: Game Stop & Naked Short Selling with Lucy Komisar – The Komisar Scoop