By Lucy Komisar

The Jist, with Josh Hamilton in London. June 8, 2021

This is a one-hour video. Click the arrow above to see it all. Starting with why you don’t read or hear this in the corporate media. You can see video segments of it below. With some of the longer key sections in text after the videos.

How Death Spiral Financing Works

Hypothecation and fake stock lending

Dark Pools and ex-clearing

Death Spiral Financing

The name used by the investment firms that offer this is convertible debentures. Or PIPE, which means private investment in public equity. And the targets are generally small companies who need capital but aren’t at the stage where they can get cash from stock sales or bank loans or bonds.

The investment firm says, we will lend you $2.5 million. That’s the sum that was promised a company called Sedona that made relationship management software for financial firms. It will be paid back in stock equivalent to $3 million. And at various dates, we will request conversions until the $3 million is paid back.

So, the company hopes this money will help their stock price go up, which makes this a good deal. They don’t know that the investment company or some officials are corrupt.

Now you have to know about naked short selling.

Short selling is when an investor sells a share he doesn’t own – yes this is allowed by the SEC – and must borrow or “locate it.” Borrow means his broker borrows it from another broker who takes it from a margin account, and who gets interest on the loan, and who sends the borrowed shares to the buyer. In 2 days the short seller must pay back the loan. A locate means the broker knows where the stock can be obtained – this is usually fake. They lie. And the seller must send the shares to the buyer in 2 days.

But the naked short sellers never cover, never send the shares to the buyers. And increasing the number of shares in the marketplace attacks the share price, drives it down. And when they are also involved in death spiral financing scams, here’s what happens.

The naked short sellers knock down the share price so that by the time conversions are required, each tranche will be paid back in many times more stock. So that if $3 million would have given the lenders a tenth of the company, by the time they are through, they will own most of the company. Or even push it to bankruptcy. Which means they never have to cover the shorts, because the company is delisted.

Eagletech, based in Ft. Lauderdale, FL, was started by Rod Young who had developed use of a single telephone line for “one number, follow me” telephone service. He needed money to develop the invention and fell into a death spiral trap.

He thought the deal was honest because it was sponsored by Salomon Smith Barney, then owned by Citigroup. meetings were held at their offices. conversion notices were sent on SSB letterhead and sent in SSB envelopes.

The Salomon leader of the deal, John Dorocki, worked with a bunch of mafiosi, literally mobsters, who fronted for investors that were really offshore shells.

The agreements banned short selling, but the chief mobster, John Serubo, paid illegal commissions to some cooperating brokers to do just that. The “investments” didn’t materialize or were cancelled out by massive naked short selling.

Broker/dealer Knight Securities facilitated a series of coordinated and synchronized “short” sales of the stock, to drive down the price from a high of $13.25 to $7.75 giving “short” sellers a profit of $5.50 a share.

When Eagletech, smelled a rat, it refused the conversions that would transfer the company to the Salomon co-conspirators.

The FBI was investigating some organized crime stock fraudsters. It busted 17 mob members led by the crooks that ran the scheme against Eagletech. It never got near SSB.

In February 15, 2005, the SEC brought a securities fraud case against Serubo and more than a dozen others. It said they generated in excess of $12.7 million from the sale of the stock. The massive death spiral scheme knocked share prices from $13.25 to $0.05.

Serubo, Labella and the other mobsters would be banned from penny stock trading and ordered to pay back the ill-gotten gains and fined.

SSB was member of New York Stock Exchange (NYSE) which was subject to oversight by the Securities and Exchange Commission, but the SEC and Justice Department never mentioned that or brought charges against the Solomon Smith Barney officials behind it.

Eagletech’s lawyer Wes Christian told me, “We contacted SEC on that and got no response at all.” “Preposterous and gross negligence.”

The court dismissed Eagletech’s lawsuit, because it said it lumped twenty-nine defendants together and failed to identify which defendant made which statement. So the allegations of fraud lacked the required specificity.

Then the SEC filed suit against the victim, Eagletech, to deregister its shares, because it couldn’t afford several hundred thousand dollars to file audited financial reports. The delisting is like a bankruptcy, all investors are wiped out and the naked shorters never have to cover. The SEC finished what the mob started, it killed the company.

There was another death spiral at about the same time

Sedona story begins in 2000

Sedona was a software firm based in King of Prussia, Pennsylvania. It was making relationship management software for companies. In the wake of deals developing with IBM and other top-line companies, Sedona wanted to hire more staff for sales and marketing.

Investment banker Michael Vasinkevich was a managing director for Ladenburg Thalmann, a prominent New York investment firm, member of the New York Stock Exchange since 1879. He was soliciting Sedona’s business and promising that he could help finance its growth.

Vasinkevich said he could get Sedona $2.5 million in a PIPE deal, Private Investment in Public Equity.

He was working with two Austrian brothers, the Badians who were introduced as investment advisers. The Badians worked through a network of offshore funds, advisers, directors and agents who seek out target companies.

The “investors” were shell companies controlled by Herbert Batliner, who, according to a 1999 German intelligence document, was in the business of laundering illicit funds. U.S. prosecutors told a Colorado federal court in 1999 that Batliner had handled money for drug dealer Jorge Hugo Reyes Torres, then serving a prison sentence in Ecuador.

The Badians’ Rhino Investors pumped $2.5 million into Sedona in November 2000 through a convertible debt offering, which which would converts to shares at a designated point. Sedona made the investors agree not to sell short the shares.

Short selling would push down the share price, and the less the stock was worth when it came time to convert the loan to shares, the more of the stock the fake “investors” would get.

When the deal signed with Ladenburg Thalmann February 2, 2000, the stock was trading at $6 a share. by March 5, the brothers did a pump on the stock. It went to $10.25.

Then started a long slide, Every time the company put out good news in the summer and fall of 2000, such as a relationship with IBM that would have made stock triple in price, as soon as it started to move up, there was heavy, heavy selling through these ECNs [electronic communications networks] that allow the seller to hide behind the ECN. It would stifle the stock.

In one month, the confederates had pushed down Sedona’s stock price from $1.64 to $1.01.

When Andreas Badian learned that the price of the stock had fallen below a dollar, he told the brokers at Westminster, in New York, according to tapes obtained by the SEC, to “keep selling” and to use “unbridled levels of aggression,” because “every dollar of that you sell is a dollar in my pocket.”

Meanwhile, the Badians’ phony “clients” were converting their shares to cash. With the drop in share prices, the conversions left Sedona still owing $1.9 million to the “investors.”

After converting some of the PIPE debentures to stock, Badian deposited the converted shares into an Amro account at a third brokerage firm, Westminster Securities, New York.

Pershing, a clearing firm for Westminster, shared office space with several Badian funds. Badian directed Westminster to engage in the manipulative short sales and Pershing (part of Bank of New York) brokered the transactions

Helping the scam, a market maker, Frankel, made fake book entries that it had bought the shares sold by a broker in Canada. The buys and sells canceled each other out.

Sedona one day received an investigator’s 330-page ring binder with analyses of 60 companies destroyed by the Badians and similar operators. In October 2001, Badian demanded a conversion. Sedona decided it was dealing with crooks and refused.

The ring binder got Sedona to go to the SEC and the Justice Department and have meetings in November 2001.

The SEC showed 82 companies reporting investments by the same scammers. 81 of them lost almost 40% of market value in the first year. Sedona lost business at a dozen companies. If your stock is tanking, companies don’t want to buy software if they think if you won’t be around to service it. Sedona had to fire employees in sales and marketing.

Following meetings with Sedona officials and the Justice Department in November 2001, the SEC in February 2003 filed a complaint against Thomas Badian and his company for fraud and market manipulation of Sedona shares. He settled with the SEC for a $1-million fine without admitting or denying guilt.

The Justice Department charged Andreas Badian in a criminal case, but he jumped bail and is a fugitive in Vienna, Austria. The Department dropped its criminal case against Andreas. It declines to say why.

In May 2003, Houston lawyer Wes Christian filed a civil action for Sedona against Ladenburg Thalmann, Vasinkevich, Badian, and others.

In 2006, the SEC filed a civil suit against Andreas Badian, and some officials of complicit traders, but not against Ladenburg, the high-profile broker-dealer that facilitated the deals or Westminster, a major broker dealer involved.

Wes Christian told me: “The U.S. government chose to go after the low hanging fruit, the Badians. They had the clearing firm, the broker dealers, they had it all, but they dropped it.”

The New York judge sat on the cases for nearly a decade. She dismissed most of the Sedona defendants, including central figures, Thomas Badian, the object of civil charges by the SEC and criminal charges by the Justice Department, and Michael Vasinkevich, the New York operator who arranged the deal.

The alleged co-conspirators, Pershing, Westminster, Frankel, part of the U.S. stock market fraternity, got a SEC/Justice Department pass.

September 2012, Wes Christian settled the Sedona lawsuit with Ladenburg. It was confidential, so Christian can’t tell the details.

Vasinkevich is now Chairman and Senior Managing Director of H.C. Wainwright & Co., an investment bank.

Sedona is still in business, with a market cap of $1.9 million and stock trading at 2 cents.

Dark Pools

U.S. trades are supposed to be cleared through the Depository Trust and Clearing Corp. It’s DTC, Depository Trust Company, is the vault for all shares, digitally assigned to the major broker dealers for their clients. The NSCC, National Securities Clearing Corp is supposed to settle the trades, moving the digital entitlements between buyers and sellers brokers.

Since the mid-1990s, dark pools, have enhanced the system of ex-clearing. Dark pools are markets run by private firms or banks/prime brokers that trade outside the stock exchanges and are hidden from most investors. Dark pools aren’t exchanges, but they are exchanges. They are internal crossing/ex-clearing networks, private platforms that trade stocks away from exchanges. They are used by clients such as hedge funds to buy and sell large blocks of shares in anonymity, avoiding the risk of moving the public price of a stock on an exchange as a result of copycatting by other traders

Dark pools allow large traders to act secretly, not to inform the trading public that they are looking to buy or sell a particular number of shares. Trades are arranged confidentially, with, in theory, neither side knowing the party on the other side. The dark pool operators know both sides, and if they — the dark pool operators — become part of the trade, they know the counterparties. The argument is that disclosure of “buy” requests on an exchange would send the price up for the buyer, and large “sell” orders would push it down for the seller. Well, for big buyers and big sellers, not for ordinary investors.

Now, 40% of shares go ex-clearing, which means they don’t go through the exchanges. Prime Brokers move them between their own clients or through companies they own themselves which make up what we call dark pools. It’s not some unlit building where people furtively exchange shares for cash. It’s all done by computer.

But it evades the DTCC. when dark pool volumes are lumped in with the brokers’ transactions, the brokers bypass the more stringent post-trade reporting. It would be difficult for regulators to look at a specific trade. That allows trades to fly below the radar. They may be netting a lot of that out. That means ex-clearing, never reporting the trades to the DTCC. Combining dark pools with ex-clearing increases possibilities for concealing illegal trading activity and market manipulation.

They’re secret because the prime brokers want it that way. Because it’s a way to do scam trading without being called to account. Except – now how did this get out of jail free card get written into SEC rules? The key to scam trading is naked short selling.

The SEC Reg SHO, the regulation on naked shorting that went into effect in 2005, applies only to shares that settle in the DTCC. So if a company’s trades fail because short were never covered, they don’t fail if they weren’t settled in the DTCC.

Dark pools facilitate ex-clearing, settling within and between prime brokers, which means there is no way for the DTCC to know if trades were really completed, if shares were delivered. If the trades are processed ex-clearing, they would only be known to the trading parties. Dark pools ex-clearing trades provide an extra layer of secrecy for market manipulation.

So dark pools are a license to naked short, which means a license to steal. Because sellers sell shares they don’t own and they never have to send the real shares to the buyers.

Don’t worry, the buyers don’t know, because their brokers give them digital entitlements. Of course, if you don’t have real shares you can’t participate in proxy votes or get cheaper capital gains tax rates. But the broker dealers don’t tell their clients their votes will not count, they will throw them out if they don’t have real shares. And they will send them payments “in lieu of dividends” and hope they don’t realize they can’t get the cheaper tax benefits.

Dark pools also played a role in GameStop manipulation. 25% of the GME float is traded OTC (over the counter in a dark pool) compared less than 1% for major stocks.

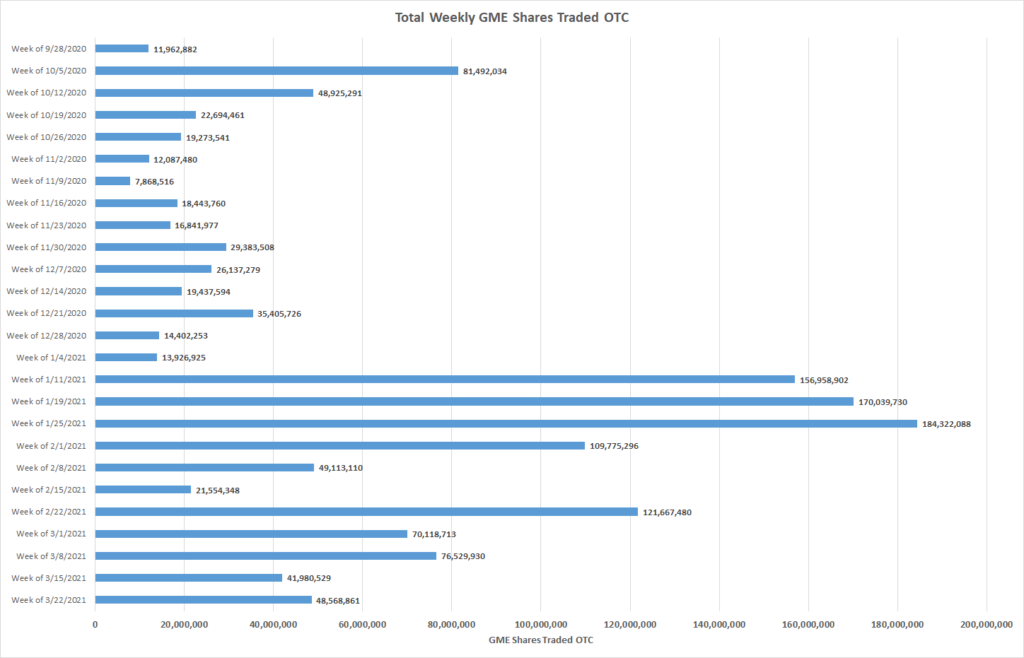

The total GME volume being traded off-exchange skyrocketed in January.

There was a spike in GME dark pool trades the end of January 2021, especially the week of January 25 when the short squeeze was shut down. The big investors who trade in dark pools increased their volume till just that week when the price dropped.

During the week of 2/22, over 526% of the GME float [the number of shares that could be traded] was traded off exchange in dark pools. That indicated massive repeat high frequency trades. By the week of 3/15, 68.58% of volume was trading off exchange.

GME OTC volume as percentage of float in February 2021 was 234x higher than the average volume as percentage of float for Dow 30 stocks. GME Traded at 655% of the float via OTC. Meanwhile average OTC trading volume for Dow 30 in February was roughly 2.8% as a percentage of float.

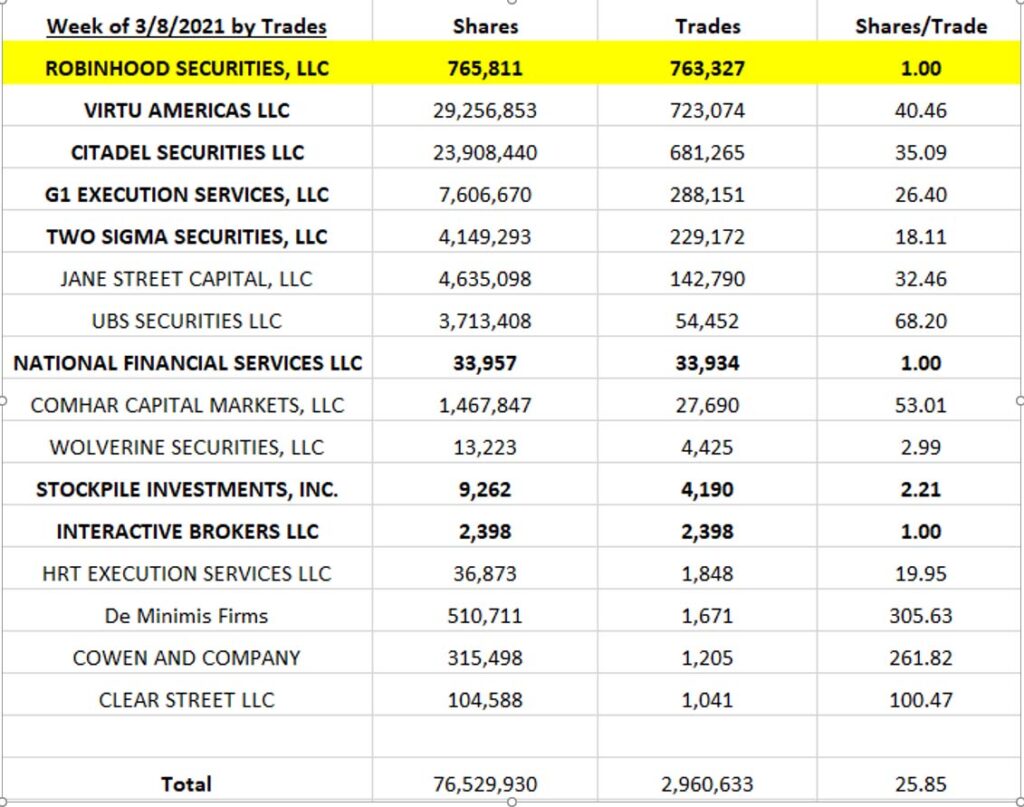

And the average trade size has since decreased to less than 50 shares per trade, despite alternative trading systems being designed to facilitate large institutional block trades. Trading single shares through dark pools, designed for massive trades, is using sophisticated high frequency trading to manipulate the market

Pingback: Special Solari Report: Game Stop & Naked Short Selling with Lucy Komisar – The Komisar Scoop

Pingback: In “Gaming Wall Street,” insiders reveal the corruption of stock market system : The Komisar Scoop

Badian is not a fugitive in Vienna. He lives in Boulder, Colorado….