And most Democrats and Republicans on the committee punt

By Lucy Komisar

Sept 9, 2022

Senator Elizabeth Warren (D-MA) asked some tough questions at a Senate Banking Committee hearing yesterday about the danger to millions of Americans having their pensions transferred to private equity firms.

She got a “no problem” response from the Treasury Department representative and, not surprising, the same from an insurance commissioner speaking for the “self-regulatory” organization that generally goes along with the interests of the industry.

Warren pointed out to the government official that a report of the Federal Insurance Office he directs last year said, “PE [private equity] owners may use investment strategies for their own insurance entities that have heightened credit and liquidity risk profiles as compared to other market participants” and “tend to hold a more significant proportion of investment in alternative or non-traditional Insurance assets that are associated with liquidity and complexity premiums.”

She asked, “You still agree with what you said?”

FIO Director Steven Seitz hedged. And he said such policyholders were covered by the individual state guarantee funds.

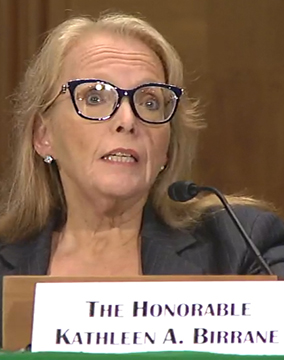

On the same theme, Senator Patrick Toomey (R-PA) asked Maryland Insurance Commissioner Kathleen Birrane, “Would I be correct in assuming that the insurance guarantee funds in the various states of would be there as a backstop to the ability of the insurance companies to honor their contractual obligation to make those payments?

Birrane, speaking for the National Association of Insurance Commissioners (NAIC), which routinely endorses industry desires, replied, “Yes Senator, that is correct.”

In fact, neither Seitz nor Birrane spoke accurately. If insurance companies can’t pay out claims, state insurance funds provide between $250,000 and $350,000 to policyholders, total, even if they were paying for benefits of $1 million or more through one or more policies. People paying years of premiums for high-end policies would lose massively.

Plus the cost is borne by policyholders of other companies that are assessed for the claims in each state. There is no FDIC-type existing cache of money. Everybody loses except the executives who benefitted from profits on risky investments that wiped out assets.

Committee chair Sherrod Brown (D-OH) opened the hearing with the question of how pension transfers posed risks to workers and to the financial system. Warren was the only one at the hearing to devote her time to that issue.

Warren asked Seitz, “Would you say that the retirees’ pension is just as financially secure now that it’s managed by a private equity owner insurer as it was before.” He avoided the question, so she answered it.

Warren said: “Exposing Americans retirement savings to more risk is exactly how private equity makes its money riskier and more complex Investments mean that private Equity back insurers can jack up their returns and their short-term profits, but the pensions are more vulnerable to being wiped out by a market downturn which in dangers the insurance companies in solvency. This is not hard. This is just how the pieces work.”

“For example, one fifth of Athene’s portfolio is invested in risky asset back securities and leverage loans made to companies that are already highly in debt and even worse many of the investments are created and managed by the parent company Apollo itself. This means that Apollo collects these on the investments that it directed.”

Senator Krysten Sinema (D-AR) was a staunch defender of private equity. She turned the problem on its head by suggesting to Birrane, “Would you say that an insurance carrier bearing some level of risk incentives incentivizes them to conduct more robust auditing and risk management since their own capital is on the line.”

Birrane replied, “I would say that insurance companies are very generally very effective at reviewing at risks and in helping their insured to mitigate those risks.”

Answering Toomey, Birrane said that insurance companies were subject to “rigorous financial reporting and oversight.” Answering Senator Bill Hagerty (R-TN), she said, “Our system is designed to have tremendous optics into the financial standing of those companies.”

Hagerty sought confirmation that private equity owned insurance was treated no different than other firms. “Are they somehow able to avoid oversight at the state level?” Birrane replied they were not.

Birrane’s comments ignore the fact that investor-owned and private-equity owned insurance companies have both gamed the regulatory system to avoid oversight. That is done largely through the multi-billion-dollar abuse of reinsurance. Reinsurance allows companies to transfer liabilities (future claims) to another company. They agree how each company will share the risk and the premiums paid by policyholders.

Reinsurance sent to independent companies doesn’t pose problems. However, the major U.S. insurance companies send billions of dollars of assets to buy reinsurance from their own affiliated companies (captives) whose books are not open to the public, because complaint states and offshore venues such as Bermuda allow it. In that case, there is no reporting and no oversight. Companies use captives to move money and liabilities from one pocket to another.

In fact, several industry-friendly states allow captives to hold as assets Letters of Credit (LOCs), which are not capital at all, but loan agreements that companies arrange with banks. LOCs are not allowed to be claimed as assets by U.S. Standard Accounting Principles. But some states allow captives to ignore those principles.

Toomey was particularly concerned about efforts among international regulators to set insurance capital standards. He said the U.S. system of state-based regulation was “truly the gold standard.”

In fact, an international proposal to ban LOCs would unleash a major terrified response by private equity and giant investor-owned insurers.

The others on the panel, Democrats and Republicans, dealt with such issues as pandemic and cyber insurance, even coverage of the cannabis industry. Their focus was on business, not workers.

The author’s research into the for-profit life insurance industry has been supported by a grant from the Fund for Investigative Journalism.

Six months after this hearing, at which Toomey carried the water of the insurance industry, he joined the board of Apollo. Directors are paid more than $350,000. Is that a payoff?” It’s how much of Congress works.