© By Lucy Komisar

100Reporters

Sept 12, 2022

Trade Unions sound the alarm

Financial Stability Report

Federal Insurance Office

Alcoa Corp

Lockheed Martin Corp

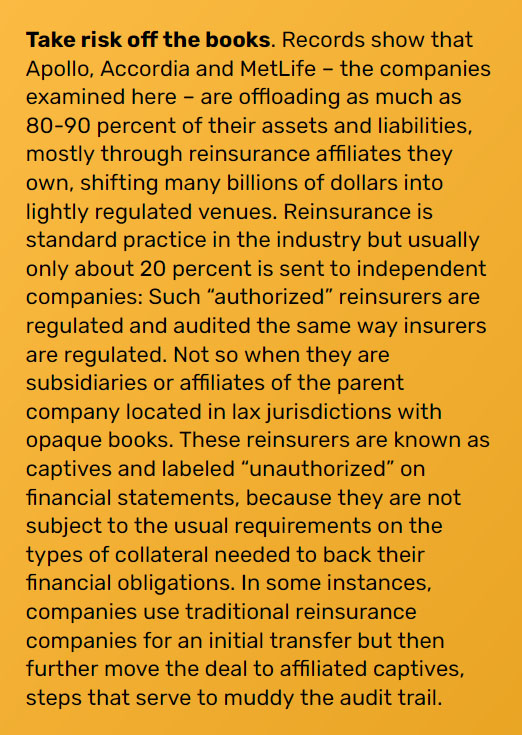

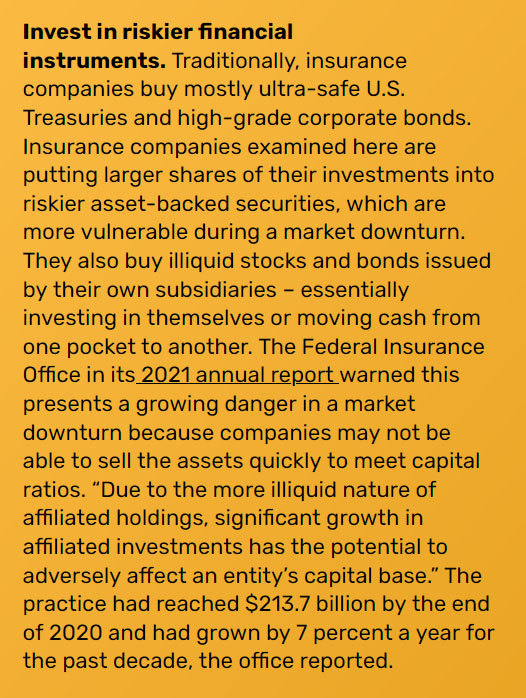

There are four key practices all the companies in this report employ.

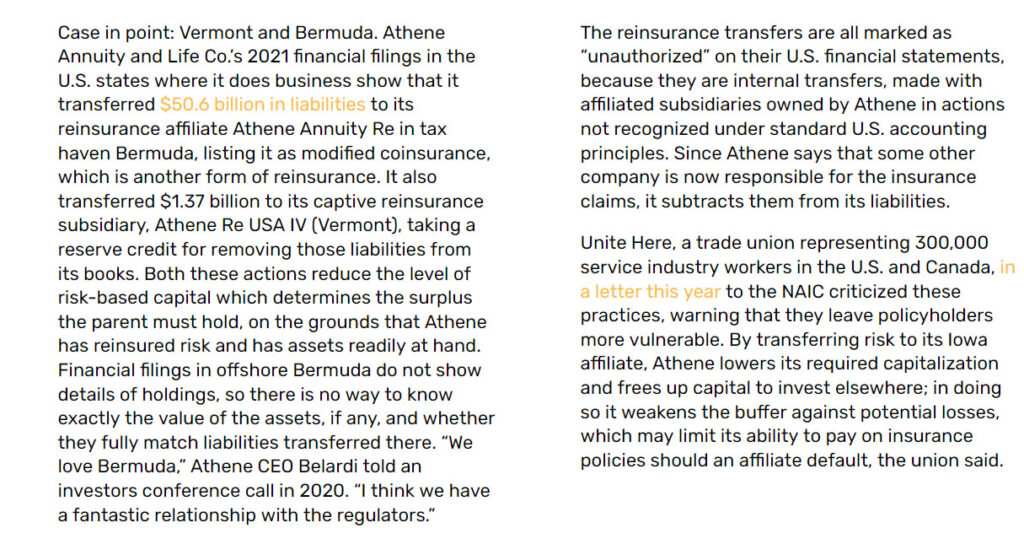

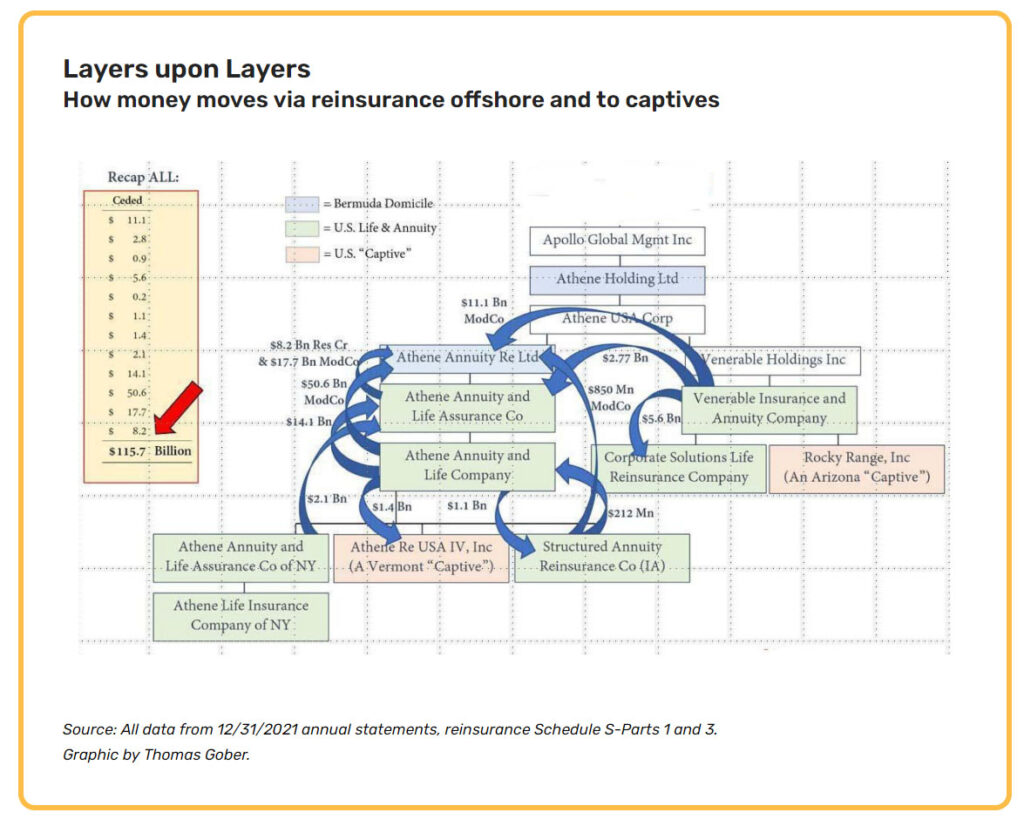

$50.6 billion

UNITE HERE letter

Reserve Credit

Reinsurance Charleston

FSOC

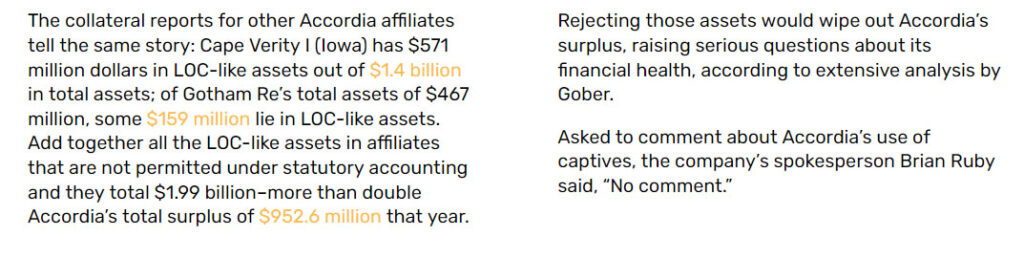

$1.4 billion

$159 million

$952.6million

Pingback: The Lies of Bill Browder & the Magnitsky Hoax [Lucy Komisar Canadian Patriot interview] – the Canadian patriot

Pingback: The Lies of Bill Browder & the Magnitsky Hoax [Lucy Komisar Canadian Patriot interview] - All View News

Pingback: Matt Ehret interviews Lucy on the Browder hoax : The Komisar Scoop

Pingback: Risky Business: How Insurance Companies are Chasing Profits over Policyholder Security : The Komisar Scoop

How do consumers find out if their life insurance company is credit worthy? Is it a mistake to cash out of a long-held life insurance policy in these turbulent times?

If the company is not-for-profit it is safer than a for-profit company, which exists to increase the pay packets of its executives.

You have to decide whether the money you have put into a for-profit company is worth what you still have to pay. Which may be less than getting a new policy.

Unfortunately, if a for-profit company fails, under existing state law, all the companies in the states where they exist have to pay out to the policy-holders of the failed company.

Only answer is federal regulation, but the big for-profit companies like Athene (Apollo) have obviously bought key members of Congress. And even the Senate Banking Committee, with people like Elizabeth Warren, does not deal with or maybe doesn’t understand this.

Fantastic Information!

Do all insurance companies follow these risky practices, or are some safe?

Will you also comment on whether annuities are safe for retirees?

The not-for-profit insurance companies are more likely not to follow these risky practices since they are owned by their policy-holders, so executives do not make money by gambling on risky assets.

Same answer for annuities: best to go to a not-for-profit company not using assets to boost their pay packets.

Unfortunately, if a for-profit company fails, under existing state law, all the companies in the states where they exist have to pay out to the policy-holders of the failed company.

Only answer is federal regulation, but the big for-profit companies like Athene (Apollo) have obviously bought key members of Congress. And even the Senate Banking Committee, with people like Elizabeth Warren, does not deal with or maybe doesn’t understand this.

Thank You Lucy!

I don’t understand what you are saying, will you please explain:

“if a for-profit company fails, under existing state law, all the companies in the states where they exist have to pay out to the policy-holders of the failed company.”

Also, my wife’s mom has most of her retirement dollars in annuities with Mass Mutual. I looked at their numbers, and they have 20% of assets listed as “other invested assets” which “Includes common stock of subsidiaries and affiliates, derivatives, and receivables for securities”

See Here:

https://www.massmutual.com/efiles/corp/pdfs/ms1003.pdf#page=6

Do you have sense of whether this company looks safe or not?

If it’s a mutual that is good, owned by the policy-holders, not investors who care about their profits over policy-holder benefits. Though investing a big amount in their own subsidiaries is not great.

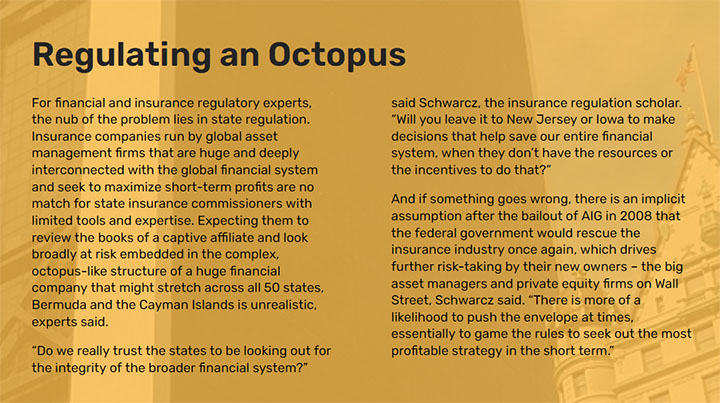

The problem is that under state law (the result of for-profit companies buying the US Congress and allowing the states to set the law), if any company fails, even because of their own corrupt or risky practices, all the companies in the state where it has policy-holders must share the cost of the payout to the company’s policy-holders. Of course that is corrupt. Because when it comes to insurance regulation, the Congress is corrupt.

Thank you again, Lucy!

Every financial analyst that I pay attention to believes we are headed for a global economic and financial collapse. Insurance companies are invested mostly in bonds and real estate and many will go bankrupt. Would the government respond with a bail out the life insurance companies, and what would happen to policy holders?

It seems to me that buying anything from life insurance companies carries a high risk of loss. What is your opinion?

Under state laws, if a life insurance company goes under, states will payout up to $250 to $300G total (states differ) even if a person had multiple policies. Then all the companies in the state are assessed for the cost. Safest companies are the mutuals (beneficiary-owned). For anything dicey, the danger is in getting a policy higher than the top amount that will be paid out by the state where the policy is listed. (Remember the big companies exist in many states.) On the other hand, since corporations control the govt, it’s possible the feds will figure out a bailout. It’s just your money!