State aided suspect in huge swindle

Florida regulators — over objections by state’s top banking lawyer — gave sweeping powers to Allen Stanford, who would be accused of swindling investors of $7 billion.

By Lucy Komisar, Michael Sallah and Rob Barry

Miami Herald, July 5, 2009 (on Wayback Machine)

[Lucy Komisar brought this story to the Miami Herald, which assigned two of its staff to do added local reporting.]

Winner in 2010 of

* Gerald Loeb award for business and financial journalism by medium & small newspapers;

* National Press Club award for Newspaper Consumer Journalism;

* Sigma Delta Chi award for Non-Deadline Reporting (Daily Circulation 100,001+) bestowed by the Society of Professional Journalists;

* National Headliner Award, second place for Business News, administered by The Press Club of Atlantic City;

* Sunshine State Award, first place for Non-Deadline Business Reporting, given by South Florida chapter, the Society of Professional Journalists.The story led to a reform bill passed by the Florida legislature in 2010.

in Houston June 29, 2009. Pat Sullivan/ AP Photo

Years before his banking empire was shut down in a massive fraud case, Allen Stanford swept into Florida with a bold plan: entice Latin Americans to pour millions into his ventures — in secrecy.

From a bayfront office in Miami in 1998, he planned to sell investments to customers and send their money to Antigua.

But to pull it off, he needed unprecedented help from an unlikely ally: The state of Florida would have to grant him the right to move vast amounts of money offshore — without reporting a penny to regulators.

He got it.

Over objections by the state’s chief banking lawyer — including concerns that Stanford was laundering money — regulators granted sweeping powers never given to a private company.

(Read the Stanford Trust Memorandum of Agreement with Florida.)

The new company was also allowed to sell hundreds of millions in bank notes without allowing regulators to check for fraud.

Over the next decade, the Miami office was among Stanford’s busiest in the sale of controversial investments now at the heart of the federal government’s sweeping fraud case against Stanford and his lieutenants.

”There was no lawful way that office should have been opened,” said Richard Donelan, the state’s chief banking counsel who opposed the deal.

Donelan said he argued that the Stanford plan violated state law, and that there were concerns about money laundering in the Caribbean and whether Stanford’s bank was in conformance with the law.”

(Read the internal agency argument about the Trust office.)

TAKING ADVANTAGE

Represented by a powerful Florida law firm, Greenberg Traurig (https://www.gtlaw.com/en/locations/miami) Stanford got approval to create the first company of its kind: a foreign trust office that could bypass regulators, according to records obtained by The Miami Herald.

gives no reason for overriding banking lawyer

and allowing Stanford to move money offshore.

The Florida banking director who signed the agreement, Art Simon, now admits he made a mistake.

Upon reflection, would I have liked to have done it differently? Would I have liked to stop them from doing what they currently did? Yes, of course.”

The state’s decision allowed Stanford to expand his banking network by offering his prize investments — certificates of deposit — without reporting the purchases, according to state and court records.

In the first six years, the office — known as Stanford Fiduciary Investor Services — took in $600 million from customers, state records show.

Now, with Stanford indicted on sweeping fraud charges last month, the Miami office poses serious challenges for federal agents trying to find assets from the demise of his vast banking fortune, legal experts say.

In all, prosecutors say Stanford diverted nearly $7 billion from customers who purchased his CDs, long touted for their high returns.

Some of the millions went to support Stanford’s lavish lifestyle, including private jets, expensive cars and mansions, including a $10.5 million home in Gables Estates that he has since torn down, records show.

Investors who flocked to the luxury offices on the 21st floor of the Miami Center to buy the CDs are clamoring for their money, saying they were fleeced of millions.

”It’s not fair that so much money has gone down the drain,” said Margie Morinaga, whose 84-year-old father lost $400,000.

Former customers are sending letters to the court receiver, pleading for help; others are angrily organizing to press for the recovery of their money.

At least 2,100 customer accounts were set up at the Miami office in the first six years, state records show.

Unlike other Stanford companies around the country, the Miami office was exempt from reporting the amounts of money sent overseas — bypassing anti-laundering laws.

In fact, employees shredded records of the trust agreements and CD purchases once the original documents were sent to Antigua, state records show.

FEW PROTECTIONS

For years, the high-rise offices — adorned with marble floors, Oriental rugs and expensive artwork — provided privacy for investors, but few protections.

Because trust officers weren’t required to keep records, investigators will have to rely on investors and the Antiguan bank to trace the money that moved through the office, say lawyers for customers.

Officials for the Florida Office of Financial Regulation are now reviewing the decision made a decade ago, but they refuse to comment.

Officials for the Florida Office of Financial Regulation are now reviewing the decision made a decade ago, but they refuse to comment.

”All I can tell you is that there was no one that specifically regulated the office,” said Linda Charity, director of the state’s Division of Financial Institutions.

Simon, the Florida banking director who approved the agreement, says he should have banned the office from handling money.

”It raised serious questions in my mind after the fact as to whether we should have had tighter provisions,” said Simon, a former state representative who helped draft much of Florida’s modern banking legislation.

The office was only supposed to provide information for people interested in the offshore trust’s services — not offer CDs and accept money, he said.

But in clear language, the agreement reached between Stanford and state regulators allows money to flow to and from the center.

Simon, 63, now retired from state government, said he didn’t recall the language until he was e-mailed a copy by The Miami Herald.

But several lawyers who reviewed the documents for The Herald said much of the responsibility rests with Simon. ”In this case, he was responsible for having an effective system of enforcement,” said Jeffrey Sonn, a Fort Lauderdale securities attorney. The state didn’t do the kind of reviews it needed to do.”

Miami banking lawyer Jose Sirven said the state may have been able to approve the office, but questioned the state’s decision to let employees transfer money.

Donelan, the state’s chief banking counsel, said he did not believe Stanford had the right to open the satellite office in the first place.

It was not an American financial institution. I had expressed that opinion. There was no regulation. It was as if they had an office that could be selling shoes or ice cream.”

CONCERNS RAISED

Now an attorney with Florida’s Department of Financial Services, Donelan, 58, said he had other worries. There were regulatory issues about the role that Mr. Stanford was playing as far as the circulation of money in the Caribbean.”

Seven years earlier, Stanford had run into problems while owning a bank on the Island of Montserrat, voluntarily giving up his license during a British money laundering investigation.

But during negotiations with the state, lawyers for Stanford argued there was nothing in Florida law that banned the kind of company Stanford wanted to create.

They also said the new company would abide by an agreement with the state, including the right to transfer money for clients, but not operate as a bank.

The agreement also barred employees from giving financial advice to customers.

Carlos Loumiet, a former Greenberg Traurig lawyer who helped draft the deal, declined to comment, citing ethical concerns.

(Read the Greenberg-Traurig law firm memorandum)

In the end, the Miami company was allowed to open under a unique category: a foreign trust representative office — the only one in Florida.

While the state allows out-of-state trust companies to set up satellite offices in Florida — catering to snow birds loyal to their hometown banks — there are no provisions in Florida law for similar foreign offices.

Stanford’s negotiation with the state wasn’t the first time the flamboyant tycoon tried to open a local office to serve his offshore venture.

Earlier, he went to Miami attorney Bowman Brown, who said he declined to represent Stanford. A longtime banking lawyer, Brown said there were several elements that didn’t seem right about Stanford’s plan.

”He wanted to set up an office in Miami to serve a business operation in the Caribbean,” said Brown. The idea was to attract a Latin American clientele as a platform to sell securities.”

But Brown said Stanford was not interested in undergoing any substantive banking regulations or submitting to government examiners.”

At the time, the Caribbean basin had a ”bad reputation as a pirate banking jurisdiction, and I just wasn’t interested in taking part in this,” Brown said.

THE BUSINESS GROWS

By the time the state approved the trust office in December 1998, Stanford was already hawking his top product: certificates of deposit.

One of the attractions of the CDs were the competitively higher yields than other banks — often by two points.

The Miami office was a big draw for foreigners jetting to Miami, said Charles Hazlett, a stockbroker who worked for another Stanford firm — a brokerage — on the same floor.

”The trust office was one of the busiest in the Stanford operation,” said Hazlett. Compared to us, they were a big office, 30 to 40 people, everyone selling CDs.”

Hazlett said the Stanford stockbrokers were also pushed to sell the company’s signature product.

Rosa Mejia says word of the Miami office spread throughout the hemisphere. She recalls escorting her father to the Miami office four years ago.

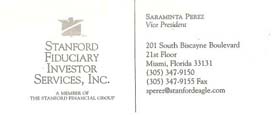

Their trust representative, Saraminta Perez, offered a five-year, $300,000 CD at higher returns than most banks, said Mejia.

Their trust representative, Saraminta Perez, offered a five-year, $300,000 CD at higher returns than most banks, said Mejia.

Her father, 69, a retired banker from the Dominican Republic, signed a trust agreement and a check. The money was to go to Stanford’s bank in Antigua, which issued the CDs.

”We thought the money would be safe,” Mejia said.

Perez referred questions to her lawyer, saying her career was cut short by Stanford’s collapse.

Miami attorney Jeffrey Tew said trust officers didn’t know money for the CDs was allegedly being stolen by Stanford and others. ”There were people [in the Miami trust office] managing $100-million-dollar portfolios,” he said. They thought they were helping their clients.”

However, Hazlett says he raised concerns in 2002 about the legitimacy of the CDs with the Miami office’s executive director, Nelson Ramirez.

”I remember very clearly saying the math didn’t add up, that I needed more information on the background of these CDs,” said Hazlett, who pressed the issue with Stanford supervisors during a compensation suit in 2004.

Ramirez, who left Stanford three years later, did not return phone messages.

Ultimately, Hazlett said he was given information about the Antiguan bank’s investments — the foundation of the CDs — but the data was so minimal ”it made me even more suspicious,” he said.

Federal agents now say the bank’s investments were vastly overvalued and, in many cases, fabricated.

After the Miami trust office was created, Stanford lawyers approached Texas to open a similar office there. In 2001, the state agreed, but with a key difference: The Texas office wasn’t permitted to handle money.

”Basically, all they could do was market,” said Deborah Loomis, assistant general counsel for the Texas Department of Banking.

But the Miami office was busy taking in money from customers — and growing, from 18 employees in 2001 to 46 by 2005.

‘HUGE RED FLAGS’

While the state agreement barred the office from giving financial advice to clients, several experts said the state should have been monitoring the sale of Stanford’s CDs.

”I can tell you that CDs are securities and are supposed to be regulated,” said Sonn, a securities attorney.

Sonn also cautioned the high yields offered by Stanford’s CDs were ”huge red flags” that should have prompted state investigators to challenge claims the products were rooted in legitimate investments.

Andrew Stoltmann, an adjunct professor of securities at Northwestern University, said the state failed by not performing routine examinations.

”You have to put yourself in a position to at least try to catch people committing fraud,” said Stoltmann, who practices securities law in Chicago.

Records show that state examiners visited the office three times over the past 10 years, but only to ensure that the 1998 agreement was kept.

During one of those visits in 2001, state agents noted that office employees routinely would send purchase records to Antigua and then destroy the local documents.

It wasn’t until February that the office was finally shut down — along with Stanford’s bank network — when the U.S. Securities and Exchange Commission filed fraud charges against Stanford and his top officers.

The office furnishings, including cherry-wood desks and company credenza, are now for sale.

Rosa Mejia, whose father lost $400,000 in worthless CDs from the Miami office, said investors were impressed by the staff and offices on the 21st floor. ”Everything was first class,” she said. We thought our money was safe.”

Gerald Loeb award for medium and small newspapers.

Winner Lucy Komisar poses for a photo.

State Aided Suspect in Huge Swindle

![]()

Comments on this story:

The New York Times: Stanford funneled millions under Florida’s nose.

Columbia Journalism Review

Story leads to Florida reform law

As a result of this story, the Florida legislature in 2010 passed a law giving the Office of Financial Regulation authority to regulate international trust company representative offices (the Stanford structure) and ordered such offices to meet minimum licensing requirements and be subject to the examination and enforcement authority of the OFR.

The Florida Senate Banking Committee staff analysis said, The impetus for providing this additional regulatory authority is to prevent future Ponzi schemes resembling the one allegedly executed in recent years by Allen Stanford.

Staff analysis of SB 1264 that was passed and codified as Chapter 2010-9, Laws of Florida.

No major newspaper other than the Miami Herald reported this story. Because, if their reporters didn’t report it, it was not news. They wrote about the Antigua soccer team losing its funding. They did not report how Florida had facilitated the Stanford fraud by allowing him to move money offshore with no regulation. Another egregious failure of American media on the matter of systemic offshore money-laundering. #abolishtaxhavens

In 2012, Stanford was sentenced to 110 years in prison.

Art Simon went on to be a “senior lecturer” at the University of Miami. His as****@***mi.edu“>bio doesn’t mention Stanford.

The Biden family connection. Hunter Biden sought changes to his personal Wikipedia entry, including deletion of his ties to Stanford. The Stanford Financial Group had a joint venture with Paradigm Global Advisors, the Biden family hedge fund, which Hunter ran as CEO for five years with along with his uncle James Biden. https://www.leefang.com/p/emails-show-hunter-biden-hired-specialists

Pingback: La Narco Sistema: Florida banking agency helped Stanford set up unregulated office to sell his phony CDs | The Big Picture

Another shame for US “regulators”. Illustrating again that the regulators are “captured”.

I doubt, given how corrupt our regulators are, that we find out how the actual scheme was intended to work.

It is possible that Stanford took dirty money from Caribbean druggies and returned it “clean” minus a 20% “cut”. In return he took money “on loan” from these CDs at rates of say 10%. This is a net interest margin of 10%.

I doubt we will find out how it actually worked. Because this is cover-up nation. The involvement of the US government indicates Stanford served truly covert and useful purposes. We will never know.

Sorry for the “chain” posting, but as afterthought it could work like this:

Stanford trust takes CDs from Florida investors yielding 10%.

Deposits CDs in treasuries earning 3%.

Gives fake paper “loans” to shady characters in return for 20% fee / or cut.

This cleans the (remaining 80%) money the shady characters have; they can “legitimately” invest it, after all….it’s NOT theirs, it’s a “loan” from Stanford Bank/Trust based in Florida of all places!.

Stanford earns NIM of 13%.

Who are these “shady characters”? Surely the people have right to know.

Pingback: Lucy accepts trophy for Loeb award | The Komisar Scoop

Being named as the Expert Witness in this case..before the funding was dried up

Stanford, utilized a network of complicitors..which remains a total mystery, as to

why, no more indictments have been handed down.

RER

Pingback: Greenberg-Traurig lawyer-collaborators of Ponzi schemer Allen Stanford fined less than 1% of loot & no jail time – The Komisar Scoop