By Lucy Komisar

May 22, 2018

The Senate Judiciary Committee’s Trump Tower meeting testimonies were released May 16th. So far, a week later, the mainstream media has not analyzed Paul Manafort‘s “cryptic” cell phone notes, below. Not hard if you look at Russian lawyer Natalia Veselnitskaya‘s 2017 Judiciary Committee testimony, which correlates perfectly with the notes and appears to follow in more detail the script of the 2016 meeting. As the U.S. media has gotten the Browder story wrong, this would spotlight inconvenient truths about Bill Browder and his major client, Ziff Investments.

Here are Manafort’s notes and Veselnitskaya’s testimony, which parallels the points he jotted down from the meeting. (There is no audio or transcript.) I added the subheads to the lawyer’s testimony to track Manafort’s notes.

Bill browder

Natalia Veselnitskaya: Since 2013, I have been investigating the activities of William Browder in the Russian Federation. And the fact that today, the Senate Committee and at least three other bodies – two intelligence committees and a special attorney – are investigating me and my colleagues, as well as the U.S. President himself and his friends and family, is a well prepared entree served by William Browder -a tax fraudster who has been under investigation for 12 years, who was convicted in Russia and sentenced to nine years in prison without the right to ever conduct business again, whose name is on a federal wanted list, and who is a former U.S. citizen who renounced his American passport in order not to pay U.S. taxes.

The results of my expert-analytical investigation of Browder’s story reveal the motives, causes and possibilities of committing crimes in the territory of Russia and the USA by a group of persons acting in the interests of Browder.

Offshore – Cyprus

NV: In 2015 -2016, I was asked by the investigation authority and the Prosecutor General’s Office to participate in the examination of the documents impounded in Cyprus from the companies specified in my inquiry. In addition, I examined the expert materials concerning the movement of stocks, as well as the criminal case materials.

By May 2016, I had found out that the assumed income increased by 66 million shares of Gazprom OJSC and was withdrawn under the guise of paying dividends from Russia to Cyprus and then from Cyprus to Ziff Brothers’ U.S. companies totalling about $ 1 billion and likely was concealed from the U.S. regulatory bodies

In December 2014, Mr. Simpson, or at least that’s what I believed, reported that the Russian company Kameya that had been a subject of a criminal investigation in Russia since May 2007, through a chain of Cyprus offshore shell companies was owned by American companies controlled directors and lawyers of Ziff Brothers.

133m shares

NV: It can be concluded from materials available in the public domain, with account for the documents I received from the Prosecutor General’s Office of the Russian Federation under the inquiry I made in 2014, as well as pursuant to the decision of the Tverskoy District Court of Moscow of June 22, 2015, and with account for the materials received during the discovery procedure in the case of PREVEZON from the U.S. Attorney’s Office that during the period of November 25, 1999 and December 16, 2004, – 133,574,722 shares of Gazprom were illegally purchased by W.F. Browder in favor of Kameya LLC in the interests of the specified persons, for the amount approximately equal to RUB 2,127,456,004.33, which at the average weighted exchange rate of dollar amounted approximately to $ 74,621,396.

Companies

NV: During the period of 1999 – 2006, an illegal turnover of Gazprom shares in the domestic Russian market in the amount of at least 133.5 million shares was carried out by companies acting under the guise of Russian legal entities, which were in fact fronting for American businessmen – the Ziff brothers. The investments amounted to approximately $74 million, but were attracted in the form of borrowed funds, bypassing both Russian legislation and the U.S. Investment Law. Net income from such activities amounted to about USD $1 billion, including 66 million Gazprom shares.

Not invest-loan

NV: Using the Kalmyk tax optimization scheme which is now recognized by international courts as illegal, Browder’s consulting teams implemented a scheme for buying Gazprom shares in the domestic secondary securities market on behalf of formally Russian companies, which in reality had only foreign capital and owners. During the period of 1997 through 2005 Gazprom shares could not be in the direct circulation with foreign companies, but only through the acquisition of American Depositary Receipts (ADRs) at that time traded at 100-150% higher price than stocks in the domestic market.

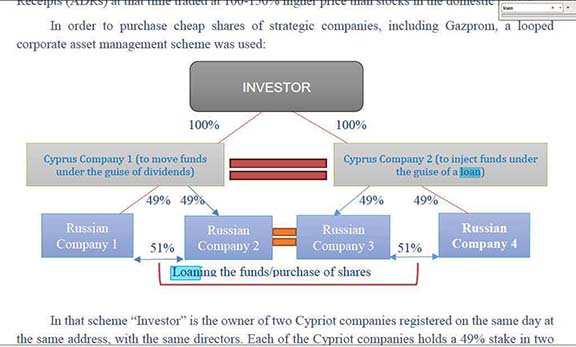

In order to purchase cheap shares of strategic companies, including Gazprom, a looped corporate asset management scheme was used:

In that scheme Investor is the owner of two Cypriot companies registered on the same day at the same address, with the same directors. Each of the Cypriot companies holds a 49% stake in two Russian Companies, also created on the same day, at the same address in Kalmykia, with the same director…. Both of the Russian Companies, though created on the same day, hold the stake of 51 % in each other. This circumstance – the excess of the share of the Russian company by 50% in the absence of a unified register of legal entities and in view of the fact that this information was stored at the local (not federal) agencies, allowed continued hiding of the fact that Russian companies were in fact owned by foreign legal entities, which created the appearance that Gazprom shares were acquired by a Russian Company in which foreign capital held a share less than 50%.

Value in Cyprus as inter

NV: The money was transferred back from the Russian companies under the guise of distribution of dividends and the repayment of borrowings. The Cypriot superstructure was used solely for the purpose of minimizing taxes on dividends of foreign companies by applying a reduced rate of 5 % instead of 15% under the 1998 Agreement made between the Government of the Russian Federation and the Government of the Republic of Cyprus. Paul Wrench – one of Browder’s main supporters -confirmed this in his affidavit (paragraph 16 of Paul Wrench’s Affidavit of July 2008 filed with the Supreme Court of the British Virgin Islands).

Illici (Illicit)

See above. I called the notes cryptic as a pseudo-joke, because media have termed them such. They are not cryptic if you compare them to Veselnitskaya’s testimony. Too much to ask of the lazy, just-give-us-something-against-Putin MSM.

BTW, wonder if the IRS is checking out Ziff Investments’ failure to report its Gazprom profits.

The rest is about Browder‘s U.S. lobbying and Russia’s response to the Magnitsky Act. Manafort got a pretty good picture of Browder’s corruption in Russia. The U.S. media apparently not so much.

The Judiciary Committee testimony link.

Pingback: WashPost again gets it wrong on Browder – The Komisar Scoop