By Lucy Komisar

Feb 13, 2020

On Fault Lines today, I talked about a couple of Pete Buttigieg‘s corrupt billionaire contributors, the Ziff Brothers. Here are some of the key points and evidence.

Forbes: Daniel, Dirk and his wife Natasha Ziff backing Buttigieg.

Forbes, which lists the Ziffs as Guttigieg backers, says Daniel and Dirk are worth $5 billion each. Based on what we know about the Ziffs and the investments conman Bill Browder handled for them, some of that money may be the profits of corruption.

They got their money the easy way, they inherited it. Their father William Bernard Ziff Jr. created Ziff Davis Media.

BUYING GAZPROM

In 1994, with the family cash, the brothers Daniel, Dirk and Robert formed Ziff Brothers Investments. In 2000, the Ziff Brothers became major investors in William Browder‘s Hermitage Fund. The Ziffs were interested in buying shares of Gazprom, the major Russian energy company.

However, Gazprom‘s charter and a 1997 presidential decree by Boris Yeltsin banned direct purchases by foreigners, including foreign companies and investment funds. The government saw the company as strategic and wanted some control over its ownership. Foreigners could buy those shares only through ADRs (American Depository Receipts) in London, but they could not buy them in such numbers and at the same price as Russians could.

Browder‘s accounting firm, Firestone Duncan, helped him evade the rules for Hermitage and the Ziffs. Konstantin Ponomarev, a founder of Firestone Duncan, told me that in 1996, “The firm developed for him a strategy of how to buy Gazprom shares in the local market, which was restricted for foreign investors.”

Ponomarev explained that, “If a foreign company or foreign-owned Russian company managed to buy shares of Gazprom in Russia, they could not register this deal properly and get title to the shares. Local prices were several times lower than prices for the same shares if you wanted to buy them outside Russian.”

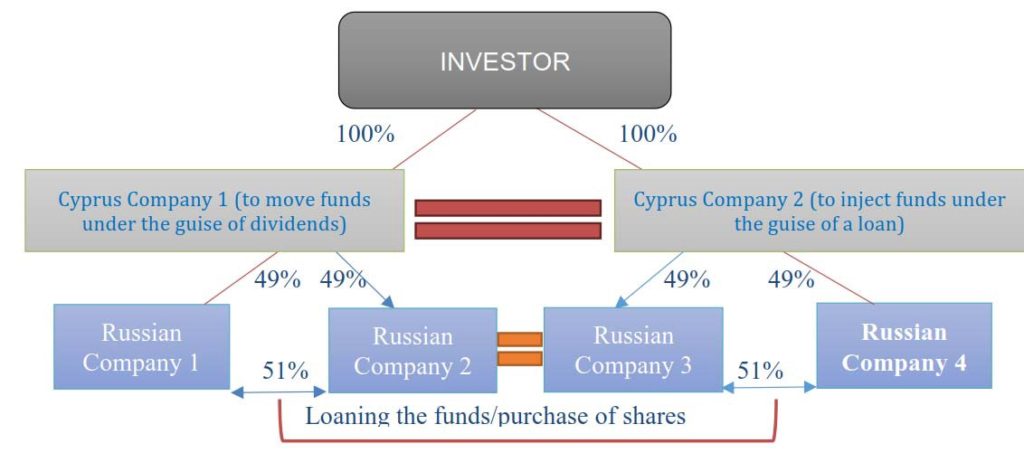

He said, “To avoid this ban, Firestone Duncan registered over 30 Russian companies, some of which were owned by myself or other FD partners. All companies owned and controlled each other. Hermitage sent its investors‘ funds to these companies as loans, then the companies would give these loans to each other. As a result, when any of these companies would buy Gazprom shares, for everyone it was a Russian-owned company with cash loaned from another Russian company.”

Ponomarev said it was clear the structure was illegal but “the price difference was so big (several times) and the risk was so low, they could not stop.”

ZIFFS OFFSHORE

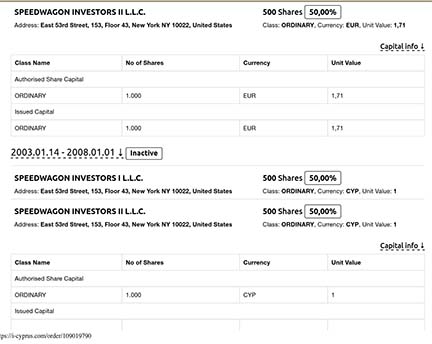

The Ziffs set up an offshore structure to hide the illicit deals. First, Daniel Ziff, established two U.S. companies Speedwagon I and II, registered in New York and Delaware. Those company filings with the New York State Division of Corporations are signed by David Bardeen, Ziff Brothers Investments counsel.

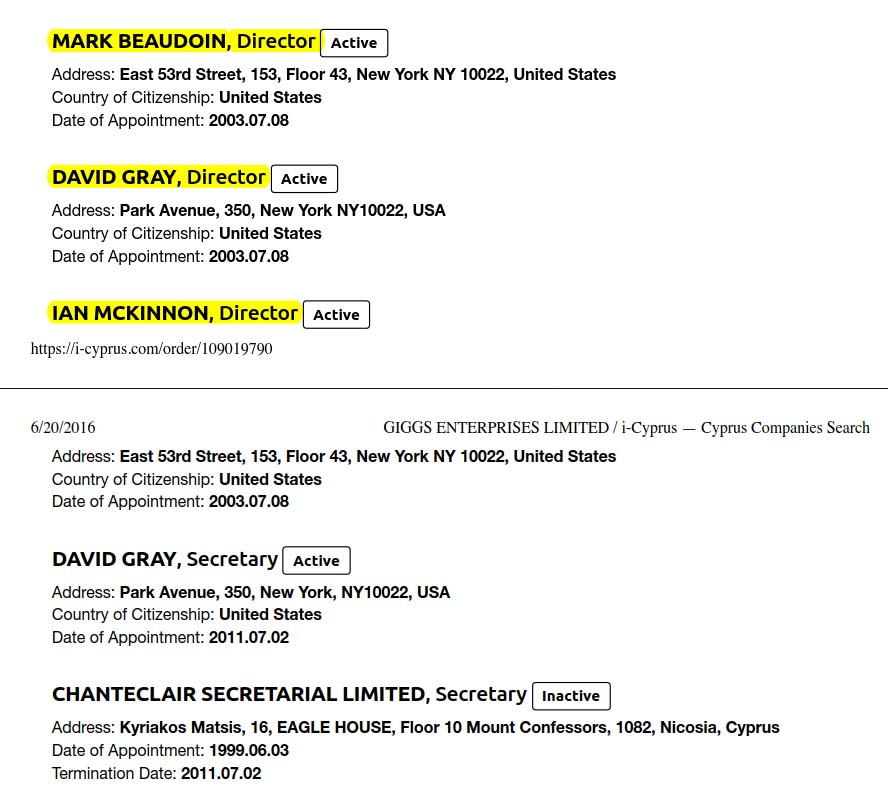

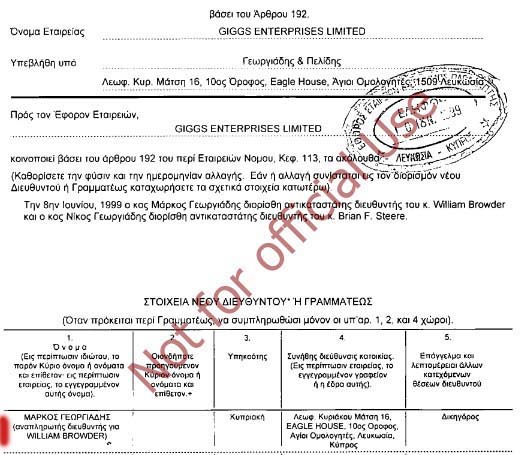

The Speedwagons then set up Cyprus shell companies, including Zhoda, Giggs Enterprises and Peninsular Heights. The Cypriot data base of registered companies lists Ziff officers. Giggs, with officers David Gray, partner and chief legal officer Ziff investments, Ian McKinnon, a longtime Ziff portfolio manager, now retired, and Mark Beaudoin of Ziff Capital Partners. Browder is listed on the Zhoda and Giggs filings, showing he played a role.

Then the Cyprus shells created another layer of front companies in Russia‘s Kalmykia region. Kameya and its trading activities were managed by the Hermitage Fund and its directors, including Browder and his partner Ivan Cherkasov. The Ziffs also had shells Baikal-M, Sterling Investments, Lori, Empire and Excalibur.

The Ziffs bought shares Gazprom on the St. Petersburg and Moscow brokerage trading floors in violation of the Russian presidential decree “On the procedure for the circulation of shares in RAO Gazprom.” The overall management of the process was carried out by Hermitage.

In 2006, according to the Ministry of Internal Affairs, the shares were consolidated in LLC Kameya. The company sold some of them, and transferred about 70 million securities in the form of dividends to Cypriot offshore companies, and they sent them to Speedwagon Investors 1 and 2.

RUSSIAN AUTHORITIES FIND OUT

The Russian Ministry of Internal Affairs investigated suspected Hermitage illegal acquisition of Gazprom shares no less than 200 million shares of Gazprom from 1997 to 2005 as well as tax evasion and deliberate bankruptcy of several companies to cover up the scam.

The investigators saw Dirk, Robert and Daniel Ziff of Ziff Brothers Investments as Browder‘s accomplices.

Russian investigators in April 2007 said that Kameya violated the law banning foreign companies from owning shares in Gazprom. Kameya was 49% owned by Zhoda, a Cypriot entity, and 51% by Baikal M, a Russian entity. [Both owned by the Ziffs.] Zhoda had a 49% interest in Baikal M, and the other 51% was held by Kameya. The roundabout structure didn‘t hide the fact that Kameya was effectively owned by a foreign company, Zhoda, and purchases of shares in Gazprom were in violation of the law, according to a report April 10, 2007 by Interior Ministry officer Artem Kuznetsov.

TAX EVASION

The Moscow Police Department said that the company had paid only 5% tax on the proceeds of the sale of Gazprom shares, rather than the 15% it should have paid, according to a report May 8, 2007 by police inspector and auditor Yuri Malofeev.

The tax crimes department of the Moscow Interior Ministry that month opened a criminal case against Cherkasov, accusing him of underpaying $44 million in dividend withholding taxes for Kameya. It said the company had wrongfully used a Russo-Cypriot tax treaty to reduce its tax payments.

According to the treaty, the companies in Russia and Cyprus had to be engaged in “economic cooperation.” But this was just a single company with a complex ownership structure. And the Cypriot company was just a shell not really managed from Cyprus. In that case, for all Firestone Duncan‘s legerdemain, the lower tax rate didn‘t apply.

On May 19, 2016 Russia‘s general prosecutor returned to the matter. The investigation focused on the illegal acquisition of at least 200 million shares of Gazprom, of tax evasion and the deliberate bankruptcy of a number of companies between 1997 and 2005.

His office had found Browder‘s Hermitage Fund and his investors, including the Ziff Brothers, had evaded more than 1 billion rubles ($16 million) in Russian taxes, including transferring profits to Ziff-controlled companies overseas.

U.S. LEGAL ASSISTANCE REQUESTED

Ziff Brothers Investments is a U.S. tax resident. The prosecutor suspected the transactions also may have violated U.S. law law on investment activity, and could be a reason for criminal prosecution by U.S. authorities. The Russian press reported that the prosecutor would request U.S. legal assistance and also tell US authorities that illegal acts might have been committed in the U.S.

Attorney Natalia Veselnitskaya explained to the U.S. Judiciary Committee in 2017 how that worked.

According to lawyer Natalia Veselnitskaya, violations included the fact that Ziff Brothers Investments was not registered with the U.S. Securities and Exchange Commission as an investment company, and therefore it could not participate in such transactions. Veselnitskaya repeated those allegations in comments to the Russian press about the Magnitsky case at the time.

On June 4, 2017, Russian general prosecutor Yuri Chaika said on national television that his agency “has presented serious evidence of violations of the law by Browder and the Ziff brothers” to U.S. officials.

The prosecutor appealed to the United States for international legal assistance requesting that the U.S. verify these transactions for compliance with U.S. financial and tax legislation and provide the necessary information on the scheme for the withdrawal of Russian assets to complete the investigation in Russia and transfer the case to court.

There was no indication of any U.S. response to that claim.

INFO GIVEN TO TRUMP JR

The documents Russian lawyer Natalia Veselnitskaya offered to Donald Trump Jr. were about tax evasion by the Ziff Brothers, who had donated to the Clinton Foundation. The Ziffs gave heavily to both Democrats and Republicans.

The Ziffs would later become part of Och-Ziff, a client of Jay Clayton, chair of the Securities and Exchange Commission.

The Ziffs are no longer investors in Russia, but are involved in other deals through their partnership in Och-Ziff Capital Management, the largest U.S. publicly traded hedge fund.

MORE RECENTLY CHARGED WITH CORRUPTION BY U.S. AUTHORITIES

The Och-Ziff fund settled in September 2016 with the U.S. Justice Department and the Securities and Exchange Commission for $412 million for having paid bribes to foreign officials to win mining rights in Chad, Niger, Guinea, and the Democratic Republic of the Congo and to the son of Libyan Colonel Gaddafi and others to win at least $300 million in investments from the Libyan Investment Authority‘s sovereign wealth fund. The fund thereby purchased a deferred prosecution agreement to avoid criminal and civil charges.

Two Och-Ziff executives, including founder and CEO Daniel Och, settled charges by the SEC that they violated the FCPA. Daniel Och agreed to pay nearly $2.2 million to resolve the SEC action. They did not admit or deny the charges.

Also on Fault Lines about the corruption of Goldman Sachs under Buttigieg donor Lloyd Blankfein.

Goldman was fined a tiny amount for cheating clients of hundreds of thousands of dollars by charging them for stock loans that were never borrowed. It was only one of many examples of proved corruption.

And the fakery of the Alex Gibney documentary about Russian tax cheat Mikhail Khodorkovsky, in my review in The Nation.

Pingback: Links 2/15/2020 – Viral News Connection

Pingback: Links 2/15/2020 - Business

Pingback: Links 2/15/2020 | naked capitalism – Litty News

Pingback: Links 2/15/2020 – HHG Radio

Great reporting (Thanks!) A few questions…

– Where/how did you verify the Ziff connections for the directors listed on the shell companies (Beaudoin,Gray & McKinnon)?

– Where is that document that shows Browder’s participation? Do we know what kind of “participation” it was?

– Peninsular Heights directors seem to be Cypriot people. How do we know PH fits in to the story?

– Is there somewhere a list of all the shell companies that were used?

– According to Browder, in the 90’s during Russian privatization, vouchers were given to citizens, representing shares in companies. Browder talks about getting into that market while he was at Solomon Bros and how he ended up starting his own Hermitage.

Thanks again!