Audio/Video, Corporate Abuses, Scoops

Sept 27, 2021 – Former hedge fund CEO Marc Cohodes discusses in this one-hour interview Overstock’s charges that Cohodes and associates faked reports to drive down the price of Overstock they were shorting, Overstock’s case against Goldman Sachs that it (and Merrill Lynch) used naked shorting to drive down its price, Cohodes’ testimony in that case about Goldman creating shares out of options trades, and why he thinks the Citadel empire should be broken up.

Audio/Video, Corporate Abuses, Scoops

Aug 18, 2021- Democratic Party insider Robert Shapiro, an economist who was a top advisor to the campaign of Bill Clinton, served as his undersecretary of commerce, and then advised the Democratic nominees after him, breaks with establishment economics to target the corruption of naked short selling.

Audio/Video, Scoops

June 2, 2021 – This is my interview of Wes Christian, the Houston attorney who has been in the forefront of bringing naked short selling cases for twenty years.

Audio/Video, Scoops

Feb 13, 2021 – The Backstory 9 Feb with John Kiriakou & Lee Stranahan ran this interview with me about the corruption of former Haiti President Aristide, and, then relating to the Browder hoax, the fakery of former U.S. Attorney Preet Bharara and the fake news printed by The Economist.

Audio/Video, Corporate/Wall St., Regulation & enforcement, Scoops

Feb 1, 2021 – How to understand the GameStop Robinhood stock spike. It says a lot more about the corruption of the stock-trading system than you have read about in corporate media.

Scoops

Melbourne, Oct 29, 2020 – The Australian parliament seems about to approve a ˜human rights‘ law that would establish the ability to exert arbitrary state power over individuals in other countries who have been accused of human rights violations. Ironically, this law gives the accused no day in court, and no chance to see charges or evidence, confront accusers, present a defense or have a ruling made by an authority other than the prosecution.

Scoops

July 29, 2020 – Swiss whistleblower Rudolf Elmer tells the story of his 15-year legal battle against Swiss judges and prosecutors and the Swiss bank Julius Baer over their charges that he violated Swiss bank secrecy.

Scoops

le 29 juli – Le lanceur d‘alerte suisse Rudolf Elmer raconte l’histoire de sa bataille juridique de 15 ans contre les juges, les procureurs suisses et la banque suisse Julius Baer contre leurs accusations de violation du secret bancaire suisse.

Scoops

29. Juli 2020 – Die Schweiz, ein Steuerparadies und legaler sicherer Hafen fíür Kriminelle, aber die Híölle fíür Informanten

Scoops

April 18, 2019 – Former Peru President Alan García, who just shot and killed himself as police were moving to arrest him for massive corruption, ran a killer paramilitary organization during the late 80s. The US knew about it but said and did nothing. I found and declassified a document in the Reagan Library revealing this and wrote about it for the Miami Herald in 2006. García was running for president again, and the Herald held the story till after the election so it would not affect the vote. So voters would not know García had run a paramilitary organization.

Featured, Scoops

100Reporters, Oct 20, 2017 – The controversial New York meeting in June 2016 between Donald Trump’s campaign team and a group of Russians, initiated as a talk about finding dirt on Hillary Clinton, is drawing new scrutiny of US economic sanctions against targeted Russians.

At the meeting, Donald Trump Jr. and other Trump confederates, lured by a promise of compromising information on Trump‘s rival, instead stumbled upon a quagmire: a fraud that bilked the Russian treasury of $230 million; a trans-Atlantic dispute over offshore accounts and tax evasion, and a U.S.-born investor, William Browder, who once ran the largest foreign investment fund in Russia, and who plays the eminence grise in this drama.

Browder is perhaps best known as an investor in Russia turned an anti-corruption activist, and the driving force behind the Magnitsky Act, the battery of economic sanctions aimed at Russian officials.

Scoops, Tax Evasion

The American Interest, May 26, 2016 – It will indeed, unless something changes, according to a member of a European Union delegation to the United States investigating shell companies.

An international agency could label the United States a tax haven as the result of America‘s refusal to require the names of beneficial owners of companies registered in the U.S. So said European MP Eva Joly, a member of the European parliamentary delegation to the U.S. that met last week with government officials and Congressmen on the issue of America‘s clandestine shell companies.

Offshore, Scoops, Tax Evasion

The American Interest, May 12, 2016 – Solving the offshore money-laundering and tax evasion system is easy, but the Obama Administration‘s proposal isn‘t the way to do it.

Stung by the Panama Papers revelations of worldwide tax evasion by the rich and powerful, President Obama has seized the moment to propose a solution guaranteed to gather headlines”and then fail. But if he wanted to, he could, through the Treasury Department, end the system of offshore tax havens with a stroke of the pen.

First, let‘s look at the solution and, then, at what‘s wrong with the President‘s proposal.

The Obama proposal acknowledges the threat offshoring poses to our national security. Treasury estimates that $300 billion in illicit proceeds are generated annually in the United States due to financial crimes. But it then essentially ignores the powerful weapon it can wield against that threat.

Scoops

Salon, Feb 24, 2016 – Betty Friedan would vote for Bernie Sanders. I say that having known Betty near the start of the women‘s movement in the late ˜60s and at the end of her life. As a feminist, she was also a progressive committed to Bernie‘s vision of economic justice. But I have another reason.

I knew Betty from 1969 when she brought me into the feminist movement, asking me to communicate to the media the message of feminism and of the National Organization for Women, of which she was founding president. Not an easy job in those days! From ridicule to don‘t take too seriously to, well, there‘s something significant happening. Rather like what Bernie has faced.

Featured, Scoops

How Browder & friends cheated Russian tax authority and minority shareholders

100Reporters, May 21, 2014 –

How William Browder & friends cheated Russian tax authority and minority shareholders.

As U.S and European governments impose sanctions on bankers, businessmen and officials close to Vladimir Putin to pressure him over Crimea, the asset freezes will lead investigators not to the Kremlin alone, but to the western-built offshore system that has helped the Russian leader and friends loot their country and consolidate power.

A case – details not public before – shows how westerners – lawyers, accountants, bankers, investors”used the offshore system to facilitate and benefit from Russian corruption.

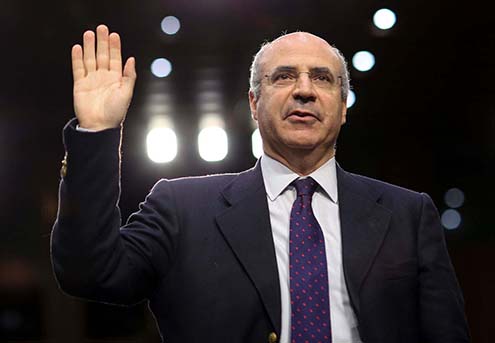

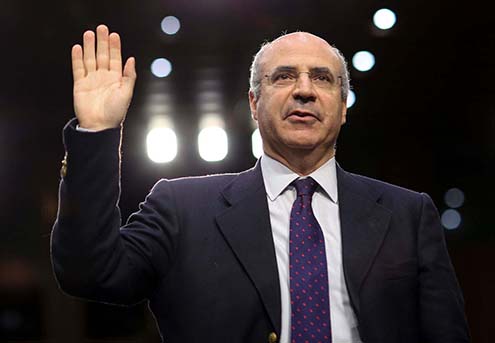

It involves William Browder (opposite), self-described anti-corruption fighter, known in Washington for winning passage of 2012 “Magnitsky Act,” which presaged current law by blocking visas, freezing assets of Russians accused of rights violations and corruption.

Browder and fellow investors stole funds diverted via an Isle of Man shell from a Russian company they controlled.

Scoops

UPI (Womens eNews), March 29, 2013 –

Betty Friedan’s parting words: We didn’t challenge the system enough. She helped start the women’s revolution but came to realize–along with many of us–that the problem everyone faced was economic predators. It’s a point to note on the fiftieth anniversary of her groundbreaking book, The Feminine Mystique.

It was Labor Day weekend 2005 at the Sag Harbor, Long Island, cottage of Betty Friedan five months before her death. I’d met Friedan in mid-1969 at a small gathering of the National Organization for Women (NOW) at the Upper West Side apartment of Dolores Alexander, a reporter for Newsday. (At that time, all gatherings of NOW were small!)

Friedan was the national president of NOW and one of its founders. When she discovered I was a journalist, she asked me to be NOW’s public relations vice president. A major NOW focus was ending discrimination against women in employment. I thought that was central to changing the status of women. So I agreed.

Regulation & enforcement, Scoops

100Reporters, March 19, 2012 – One could be forgiven for thinking that the New York State Legislature was a criminal enterprise. It had its mafioso style assemblyman, Democrat Tony Seminerio, telling a prospective “client” that he would “bury” him unless he paid off.

It had entrepreneurs like Democratic Senator Pedro Espada Jr., who set up a community health operation and, prosecutors say, looted it for millions.

It even had a comical nickel-and-dime guy, Democratic Assemblyman Brian McLaughlin, who sent one of his staffers driving on the New York Thruway with his E-ZPass so that McLaughlin could fake time in Albany and collect per diem payments.

New York State has rules against some of those practices, but rarely were they enforced against legislators who were collecting huge sums of cash from companies that wanted laws passed or state contracts awarded.

Featured, Major Past Articles, Scoops

The New York Times, Dec 3, 2011 –

An increasingly cozy alliance between companies that manufacture processed foods and companies that serve the meals is making students ” a captive market ” fat and sick while pulling in hundreds of millions of dollars in profits. At a time of fiscal austerity, these companies are seducing school administrators with promises to cut costs through privatization. Parents who want healthier meals, meanwhile, are outgunned.

Each day, 32 million children in the United States get lunch at schools that participate in the National School Lunch Program, which uses agricultural surplus to feed children. About 21 million of these students eat free or reduced-price meals, a number that has surged since the recession. The program, which also provides breakfast, costs $13.3 billion a year.

Scoops

April 21, 2011 – Businessweek censored? A press release by the New York Attorney General censored? And by the organization that represents the nation’s school superintendents and principals!

Why would the American Association of School Administrators (AASA) ban letters from legislators and government officials as well as articles in several newspapers from a display table at its February National Conference on Education at the Colorado Convention Center in Denver? Thereby hangs a corporate tale.

The AASA didn’t ban the documents over the usual culture wars issues. It was to thwart distribution of training materials on how schools can avoid being ripped off by companies that provide school meals. The papers were stacked on a paid exhibit table that had been set up by the Service Employees International Union (SEIU), which represents food service workers. SEIU had also bought the right to run a workshop.

Offshore, Regulation & enforcement, Scoops

The American Interest, Jan-Feb 2011 (online Dec 9, 2010)

Corporate secrecy, which involves hiding the identities of company owners from tax and other legal authorities, is itself no secret. It is well known that offshore banking centers such as Switzerland, Liechtenstein and the Cayman Islands have for many years enabled fraudsters all over the world to carry out scams, launder illicit profits, stash stolen loot and hide money from tax authorities.

What most people do not know, however, is that there is a vast and growing American offshore. Foreign crooks prize states such as Nevada, Wyoming and especially Delaware for state laws that don‘t require them to list owners or even company officials when a new company is formed. Corporate interests and the Obama administration are blocking congressional efforts to change that.

Featured, Major Past Articles, Offshore, Regulation & enforcement, Scoops

Barron’s, Sept 20, 2010 –

Scoop summary: Howard Jonas, CEO of U.S. telecom IDT, in an interview with Lucy Komisar, acknowledges for the first time that then Haiti President Jean-Bertrand Aristide in 2003 met with an IDT official during discussions about a contract to pay Haiti Teleco for calls from U.S. customers. That contract included agreement for IDT to send payments to a shell company in the offshore Turks and Caicos Islands. Jonas said IDT got an ethics letter from a law firm clearing the deal, but the lawyer said in a memo filed with the court, published here for the first time, that he simply told IDT to do due diligence. IDT signed the contract the next day.

A former IDT official, who objected to the deal, was fired and is suing the company; trial is set for Nov 9th. The Justice Department and Securities and Exchange Commission are investigating violation of the Foreign Corrupt Practices Act. Jonas’s revelations are likely to have a major impact in the trial and investigations.

Banks, Corporate Abuses, Featured, Offshore, Scoops

The American Interest, July-Aug 2010 (online May 18, 2010) –

As I write this, the U.S. Senate is debating a major financial reform bill in which the credit default swap, a kind of derivative, plays a significant part. An amendment to that bill, proposed by Senators Carl Levin (D-MI) and Jeff Merkley (D-OR), would ban banks from proprietary trading. There are a lot of high-rolling bankers who do not want that amendment to pass, because it will mess up their plans to repatriate foreign profits into the United States, untaxed, by trading in derivatives on their own accounts. The clearinghouse ICE Trust U.S. forms a central part of these plans.

What is ICE Trust U.S., and who owns it? ICE US Holding Co., which was established in 2008 as the parent of ICE Trust U.S., is located in the Cayman Islands. Yet none of the owners of ICE US Holding Co. are based in the Caymans. Among the owners of the Cayman‘s company are Citigroup, Goldman Sachs, J.P. Morgan, Merrill Lynch and Morgan Stanley, which are headquartered in New York. Bank of America, which now owns Merrill Lynch, is based in Charlotte, North Carolina.

Corporate Abuses, Major Past Articles, Scoops

The Big Money, March 11, 2010 –

When the devastating earthquake hit Haiti in January, IDT, the New Jersey-based global phone company, moved fast to help.

It announced it was setting up calling stations at hotels and other sites so Haitians could use its Internet calling-service to reach family and friends around the world. It cut rates on its U.S. prepaid calling-card to 2 cents a minute to Haiti (at least for 12 days), donated 4,000 $2-prepaid calling-cards to Haitian community groups in New York and Florida, and said it would give some proceeds from prepaid calls to Haitian Red Cross relief.

Such a warm, fuzzy response from a U.S. corporation often wins plaudits, though, of course, IDT has a business interest in the impoverished island. In 2005, in its latest publicly available figures, the company reported $4 million in profits from $17 million in revenues for routing calls there.

Corporate/Wall St., Scoops

portfolio.com, March 8, 2010 –

One year ago, a group of financial institutions quietly launched ICE Trust, a new and theoretically safer way to trade derivatives, a key element of the financial crisis. As lawmakers debate reform, banks at the center of the storm are remaking the market”and stand to profit.

As the financial crisis exploded with full force in 2008, it was obvious that something was gravely wrong with the huge, unregulated market for derivatives.

Lehman Brothers had $738 billion of these contracts”which are based on the value of some other asset, such as a stock or a bond or a hog belly”on its books when it failed on September 14, 2008.

Lehman certainly wasn‘t alone. Over the next few months, insurer AIG reported as much as $53.5 billion of derivatives losses”losses that were linked to nearly one third of its $182.5 billion federal

Banks, Offshore, Regulation & enforcement, Scoops

Inter Press Service (IPS), Feb 3, 2010 –

The global bank HSBC may be running offshore accounts for central banks. According to a U.S. Senate investigation, an HSBC subsidiary in London called HSBC Equator Bank had a sister bank in the Bahamas.

According to an internal e-mail, the bank told HSBC USA it had been providing offshore accounts to central banks for 20 years, because the banks wanted to avoid Mareva injunctions, legally enforceable orders to freeze funds.