Corporate Abuses, Scoops

Inter Press Service (IPS), Dec 29, 2006

Investigators find evidence that Siemens (German electronics & engineering firm), Total (French oil company), and BAE (British arms conglomerate) paid multi-millions of dollars in bribes through bank accounts in Switzerland and other offshore centers.

France and the UK argue national security to block inquiries. Concern is more likely the “security” of top officials who got kickbacks.

Spain‘s discovery that funding for Basque terrorist group ETA goes through tax havens is dramatic proof that “national security” lies not in protecting but in dismantling the global offshore secrecy network.

Corporate Abuses, Major Past Articles, Offshore, Scoops

Inter Press Service (IPS) – Nov 6, 2006

The company is under investigation by the SEC, the United States Attorney in Newark, New Jersey, and a U.S. federal grand jury for allegedly paying bribes to Jean-Bertrand Aristide, former president of Haiti. Five nationally prominent US Republicans, the independent board members of a corporation that has been charged with paying hundreds of thousands of dollars in bribes to get a sweetheart telecom deal in Haiti, are leaving its board. The company is IDT, the world’s third-ranked international phone company.

IDT is run by James Courter (shown here), a former New Jersey Republican congressman. The other Republicans are Rudy Boschwitz, former senator from Minnesota; James S. Gilmore III, former Virginia governor; Thomas Slade Gorton III, former senator from Washington State; Jack Kemp, former congressman from New York and 1996 vice presidential nominee; and Jeane Kirkpatrick, the former U.S. ambassador to the UN under President Ronald Reagan.

Corporate Abuses, Offshore, Scoops

Inter Press Service (IPS), Oct 26, 2006

The U.S. Justice Department is withholding agreement to share assets seized from Haitian drug traffickers to finance a lawsuit by the Haitian government charging former President Jean-Bertrand Aristide with taking bribes.

The suit is based on allegations by a former executive of the telecom company IDT that before Aristide left the country in 2004, he took hundreds of thousands of dollars in kickbacks from IDT, which is connected to prominent U.S. Republicans.

Corporate Abuses, Offshore, Scoops

Sept 18, 2006

Is top Justice official protecting a former client accused of bribery?

The Justice Department’s Criminal Division, headed by a Bush political appointee who gave legal advice to a company accused of bribing Haiti’s former president, is blocking an agreement to share seized Haitian drug money that would help Haiti pursue the bribery case in U.S. courts. The accused company is run by a former Republican congressman.

The Criminal Division chief, Alice Fisher, formerly a registered lobbyist for HCA, the healthcare company founded by the father of Republican Senate Majority Leader Bill Frist, is a recess appointee. Her approval was blocked by Senators concerned about her qualifications and about her participation in a government meeting on abusive interrogations at the U.S. military prison camp at Guantanamo.

Corporate Abuses, Major Past Articles, Offshore, Scoops

CorpWatch, Dec 29, 2005

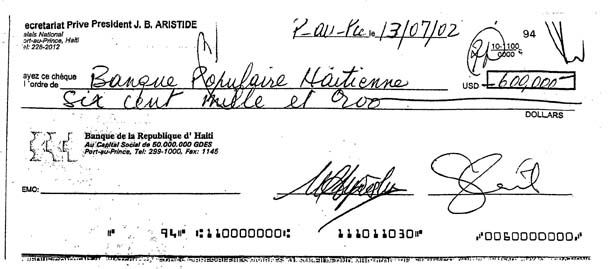

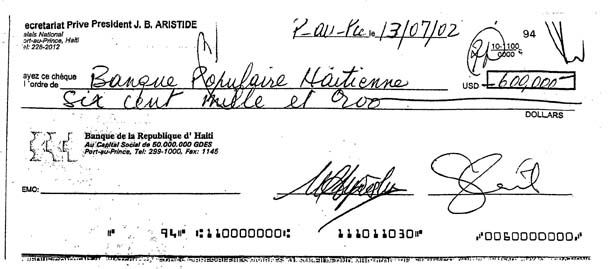

Two U.S. lawsuits charge that former Haitian President Jean-Bertrand Aristide and his associates accepted hundreds of thousands of dollars in kickbacks from politically connected U.S. telecom companies.

Lawsuits filed this Fall challenge the former priest‘s image of political purity and raise claims that both he and U.S. corporate executives scammed illegal profits off the hemisphere‘s poorest population.

In one suit, a fired executive charged his former employer, the U.S. telecom IDT (Newark, NJ), with corruption, defamation, and intimidation under the New Jersey anti-racketeering law. In the second, the government of Haiti contends that IDT, Fusion (New York, NY) and several other North American telecoms violated the federal RICO anti-racketeering statute. Both suits allege that Aristide, now in exile in South Africa, and his associates, took kickbacks.

Corporate Abuses, Major Past Articles, Offshore, Scoops

Haiti Democracy Project, Nov 10, 2005

Add former Haitian president Jean-Bertrand Aristide to the long list of corrupt and repressive officials who have used Western banks and companies and offshore tax havens to plunder their countries and launder the stolen money.

Aristide and his associates looted government coffers, wrote checks to front companies for nonexistent purchases, padded invoices to get kickbacks from vendors, secretly owned companies that cheated Haiti of taxes, and laundered the money they stole through shell companies and secret bank accounts set up in the United States and the offshore tax havens of Turks and Caicos and the British Virgin Islands.

Nearly $20 million has been documented as stolen between 2001, when Aristide took office as president for the second time, and 2004, when he fled or was forced out of the country according to varying accounts.

Corporate Abuses, Scoops, Tax Evasion

Pacific News Service – April 12, 2005

A new global movement is tracking the increasing number of offshore tax shelters and pressuring governments to make multinationals pay up.

As Americans fret over their personal income taxes, there is a movement afoot to reduce the tax burden on ordinary people by getting corporations and wealthy individuals to pay their fair share.

Last month, the Tax Justice Network (www.taxjustice.net/) issued a report based on publicly available statistics from the Bank of International Settlements and Merrill Lynch, the investment company. The data showed the following:

–Approximately $11.5 trillion of assets are held offshore by high net-worth individuals, or about a third of the total global GDP, the value of goods and services, which in 2003 was $36.2 trillion.

–The annual income that these assets might be expected to earn amounts to $860 billion annually.

–The tax not paid as a result of these funds being held offshore would exceed $255 billion a year.

Corporate Abuses, Offshore, Scoops

AlterNet, March 17, 2005.

Maurice Hank Greenberg, one of the world‘s richest men, and head of AIG, one of the world‘s largest financial companies, was forced to resign this week as prosecutors closed in on him and the company.

Given his economic and political power, the fall of Maurice Hank Greenberg, the 59th richest man in America and CEO of the American International Group (AIG), the world’s second-largest financial conglomerate (after Citigroup), is stunning.

Corporate Abuses, Offshore, Scoops

AlterNet, Dec 22, 2004

How insurance companies are aiding tax evasion by over-charging in America and shipping the money to offshore firms.

Terry Mills was working in Wilmington, DE, for J. Montgomery, one of the largest insurance agencies in the region, when in 1993 he was called in to get to the bottom of a messy insurance problem. Little did he know that he would uncover a story – as yet unreported – about tax evasion through offshore firms, but with a twist. The scheme Mills came across seemed to be taking place with the aid of AIG, a major U.S. insurance giant.

Corporate Abuses, Regulation & enforcement, Scoops

Hound-Dogs, March 2004

(Same title but not same article as in Dissent 2003)

This is a story about a massive money-laundering operation run by the world‘s biggest banks. It hides behind the “eyes-glazing over” technicalities of the international financial system. But it could be one of the biggest illicit money-moving operations anyone has ever seen. And it‘s allowed to exist by the financial regulators who answer to Western governments.

In these days of global markets, individuals and companies may be buying stocks, bonds or derivatives from a seller who is Clearstreamhalfway across the world. Clearstream, based in Luxembourg, is one of two international clearinghouses that keep track of the “paperwork” for the transactions.

Corporate Abuses, Major Past Articles, Offshore, Scoops

The Russia Journal, Nov 5, 2003

The charges against key shareholders in Yukos are enormous and very varied in scope. The Yukos tale is a long, complex and controversial one, requiring lengthy and painstaking substantiation. Public interest in the Yukos controversy is very high.

However charges and counter charges, mostly of a political nature, are being flung so wildly about in the media that The Russia Journal believes it essential at this stage to focus on the evidence in the accusations against Mikhail Khodorkovsky and his partners. His innocence of the charges that have been filed against him must be presumed until a competent trial is held.

Those who support his innocence of the charges are invited to review and comment on this, the first in a Russia Journal series on the case against him and others in Menatep Group.

Corporate Abuses, Offshore, Scoops

In These Times, Jan 17, 2003

Trade unions, workers‘ pension funds and state officials are taking the lead in a campaign to prevent companies from reincorporating in Bermuda and other tax havens”and to bring back those who‘ve already gone.

Arguing that offshore registrations allow corporations to evade taxes, reduce shareholder rights and threaten the security of investments, the AFL-CIO, individual unions and pension funds such as California‘s Public Employees Retirement System (CalPERS) are filing shareholder resolutions and going to court against companies that move their paper headquarters offshore, where corrupt corporate executives have an easier time cooking the books.